Salesforce Inc. is moving from the hype phase of generative AI into doing the harder engineering work to create the agentic enterprise.

The Dreamforce 2025 conference this week showed us that the corporate that created the unique software-as-a-service model now wants to guide what we call service as software. In our view, this represents a profound revolution, not only in technology but in business. In a world where AI agents deliver outcomes across systems of record, systems of engagement and systems of intelligence.

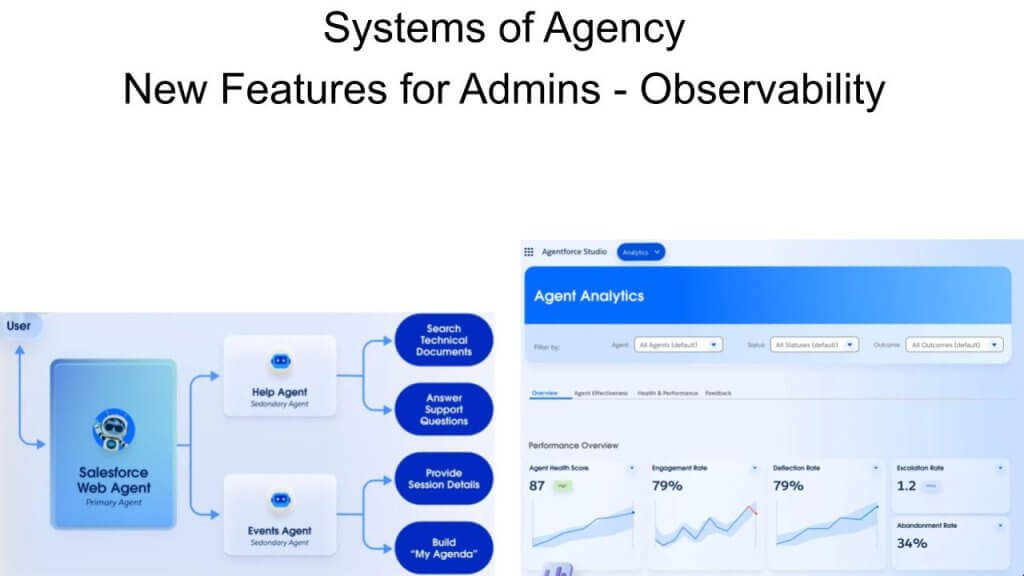

Our assessment is that Salesforce’s AgentForce 360 platform is crossing day one early versions to attack day two problems and customer requirements. What does that mean? It’s now not just demoing copilots inside Customer 360. Fairly, the corporate goes after the messy problems of observability, orchestration, data quality and the like that determine whether agent systems can scale within the enterprise.

That is where the rubber meets the road. The emergence of a brand new operations layer features critical recent functionality equivalent to agent observability and analytics. We liken this to the “Datadog for agents,” where the lineage of each decision, every workflow transition and the reasoning steps are tracked for provenance, performance and continuous learning. This learning includes absorbing the reasoning traces of humans. It’s all an extension of Data Cloud and sets up Salesforce to be a software-only agentic hyperscaler.

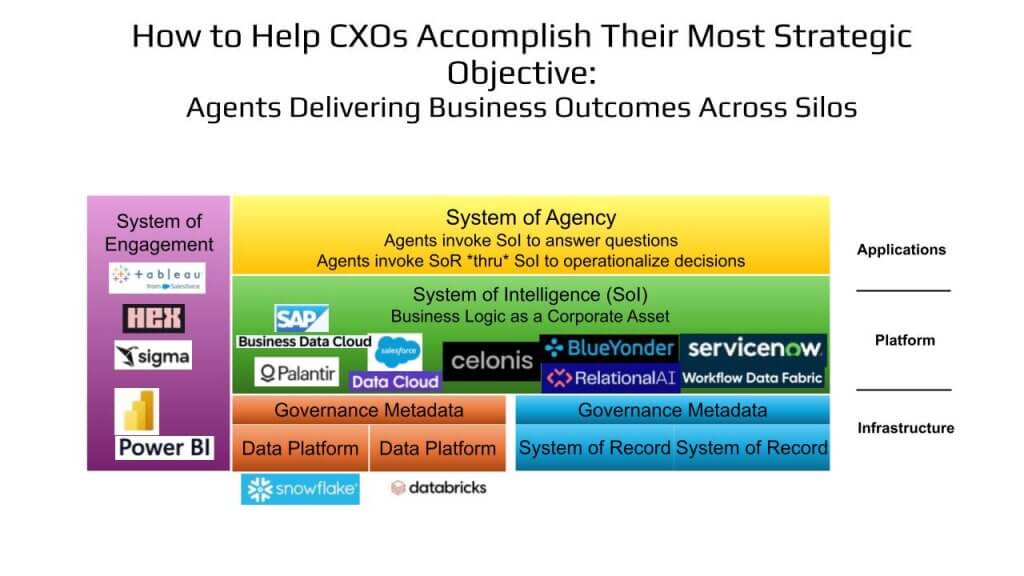

At the identical time, Salesforce is fortifying its Data Cloud as the muse of trust and accuracy. We see a brand new software stack emerging that may evolve from today’s isolated SaaS apps right into a system of intelligence, or SoI, where data governance and metadata are unified to support agentic execution. That is the day that customers, investors and top executives have been waiting for. We’re talking about less showmanship and more system architecture.

On this Breaking Evaluation, we are going to take you thru an evaluation of and takeaways from Dreamforce 2025. The strategic query that we’ll address in today is whether or not Salesforce can convert this discipline right into a durable advantage and beat the competition before the hyperscalers, other SaaS players and open-source ecosystems commoditize the agent platform. We’ll also explore how Salesforce’s open posture can attract recent partners. We’ll test our thesis that Chief Executive Marc Benioff is betting on an identical integration playbook that won the SaaS era – unifying apps, data and engagement around a scalable cloud-based operating model – around trust within the enterprise. We consider the outcomes will define not only Salesforce’s future, however the competitive balance between the builders of artificial intelligence and the operators of agentic enterprises.

How quickly can the enormous reclaim its dominance?

We selected the “King Kong” visual to set the tone because Salesforce led the SaaS revolution. The image (courtesy of Nano Banana, Gemini’s recent image generator) is intentional. Salesforce has been the King Kong of applications for a long time – dominant, visible and battle-tested. Not quite a Gulliver tied down by cords, but undeniably mature after a period where the corporate rounded out the suite. The true query now is whether or not that maturity will be converted right into a recent sort of leadership because the industry shifts from cloud-delivered automation tools to delivering work itself – business outcomes implemented in software.

We consider this marks the beginning of a 20-year reset in enterprise software. The middle of gravity moves from “sell an app that users operate” to “deliver outcomes that the software executes with human supervision.” That change just isn’t cosmetic and it forces a unique operating cadence and proof metrics. As an alternative of showcasing feature depth, the leader must prove it could possibly orchestrate agents that perceive state, determine and act across a customer’s environment to supply measurable outcomes.

Salesforce’s years of experience will be an asset if the breadth of the estate becomes a platform on which final result delivery scales with less labor. The competitive benchmark is already shown above with Palantir Technologies Inc. and Celonis SE, that are, in our view, the one vendors with offerings mature enough today to credibly claim “agent-based service as software” – that’s, systems that deliver outcomes, not only SaaS. Their presence sets the bar.

We consider the category is real and sets expectations that demos and copilots must meet or exceed. For Salesforce, the edict is to remodel platform scale and install base into operating leverage for patrons – faster paths from intent to result, fewer handoffs and verifiable business impact.

Our premise is that the mantle of “King Kong” within the agentic era will belong to the primary vendor that consistently ships outcomes at scale. Salesforce has the surface area, however the test is whether or not it could possibly convert its current maturity right into a recent velocity and prove that service as software – not traditional SaaS – defines its next act..

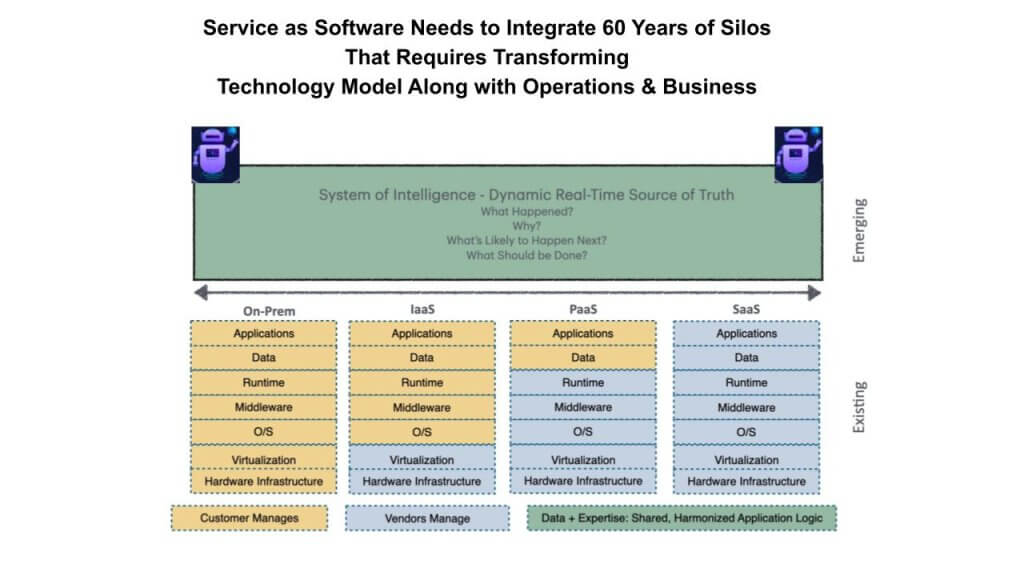

Service as software must integrate 60 years of silos

The slide below frames the next query: Salesforce led the SaaS revolution; can it lead the following one – and the way long will it take? The graphic walks through the familiar on-premises → infrastructure-as-a-service/platform-as-a-service → SaaS progression after which introduces a brand new “green zone,” the high-value real estate – the system of intelligence – where the following layer emerges.

We consider this transition is profound because every part that modified during the last 50 to 60 years – interfaces, operating models, architectures – never eliminated fragmentation. Each wave produced more silos – silos of labor automation inside applications and silos of information, and even inside “single” data lakes, data across company divisions just isn’t harmonized.

The online effect is a patchwork where outcomes require brittle handoffs across tools, teams and schemas. The green zone shown above is a possible response – an abstraction layer above apps and data that allows end-to-end work. This just isn’t just one other middleware tier; it’s a system that perceives business state across sources, reasons about what should occur next, after which acts, closing the loop with governance and measurement.

The incumbents that dominated prior layers can reclaim dominance only in the event that they capture this high-value piece of real estate quickly, since it is where value concentrates. In other words, whoever orchestrates outcomes across silos owns the control plane for enterprise work.

Time is of the essence. Pilots that stall in glue code will cede technique to platforms that turn intent into repeatable results. The “managed services” vendors of prior eras optimized pieces of the stack, while the green zone integrates the pieces right into a continuous final result path. That marks a shift from selling tools to selling work.

Our premise is that the players who win the green zone – abstracting silos into end-to-end, governed outcomes – will define the agentic era. Speed to credible, at-scale execution on this layer will determine whether past leadership translates into future dominance.

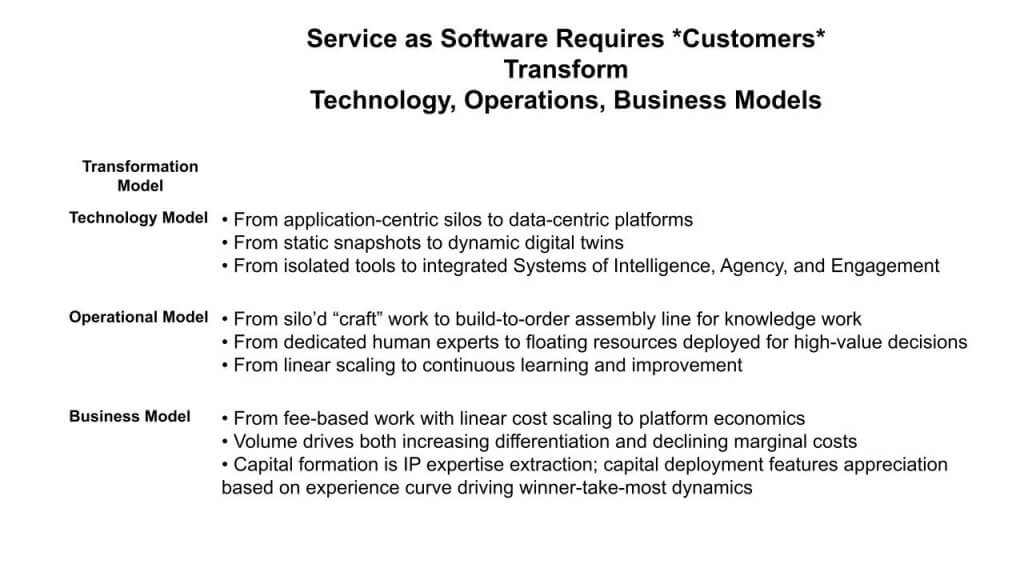

From SaaS to service as software: The following model shift

As described below and in a prior Breaking Evaluation argued that the on-prem → SaaS transition rewired every part: the technical architecture, the operating model and the business model (including pricing). We consider the industry is at an equivalent inflection, moving from SaaS to service as software, or SaSo. This time the shift extends beyond tech vendors and the data technology organization; software-like economics will flow to each company that digitizes certain expertise and delivers it as outcomes.

What changes now just isn’t just where software runs but what software delivers. In SaSo, vendors provide end-to-end outcomes – legal resolutions, call-center performance, wholesale banking services — executed by governed agents. That forces simultaneous change across three planes as described above. Three implications surface:

- Marginal costs decline because more of the expertise is in software.

- Differentiation increases as systems learn from every execution.

- The result’s winner-take-most dynamics — concurrently lowest cost and highest differentiation.

The implication is that firms can scale without proportional labor growth. That’s the economic engine of SaSo. Vendors and enterprises that operationalize digitized expertise as software services will capture outsized value; people who remain feature-or app-centric will see value pool migration to the final result orchestrators.

Our view is that SaSo extends the SaaS-era playbook in that a full-stack transformation of tech, ops and business models results. The winners will likely be those can progressively convert human expertise into governed, observable software services that learn with use and unlock declining marginal costs at volume and compounding differentiation at production scale.

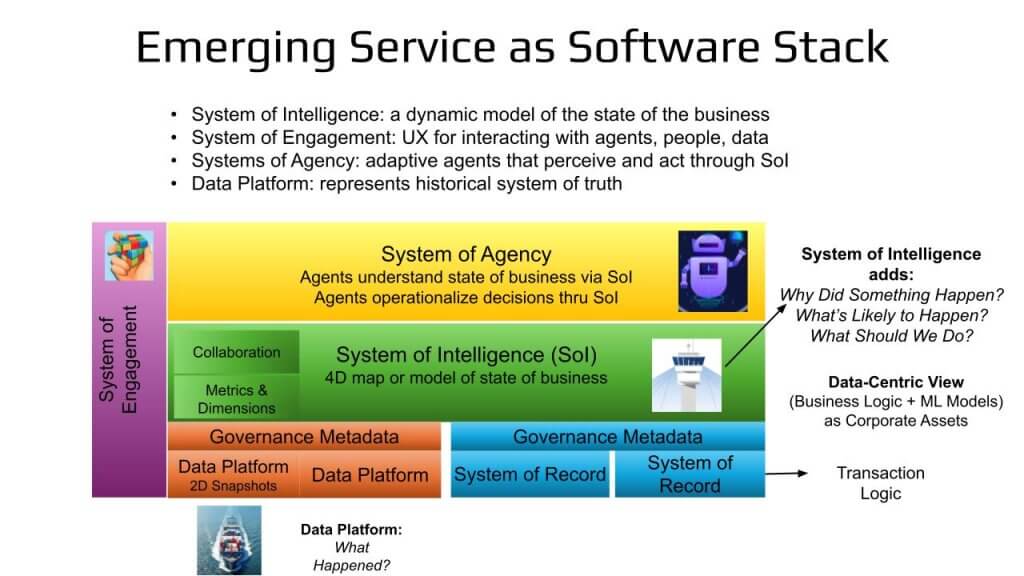

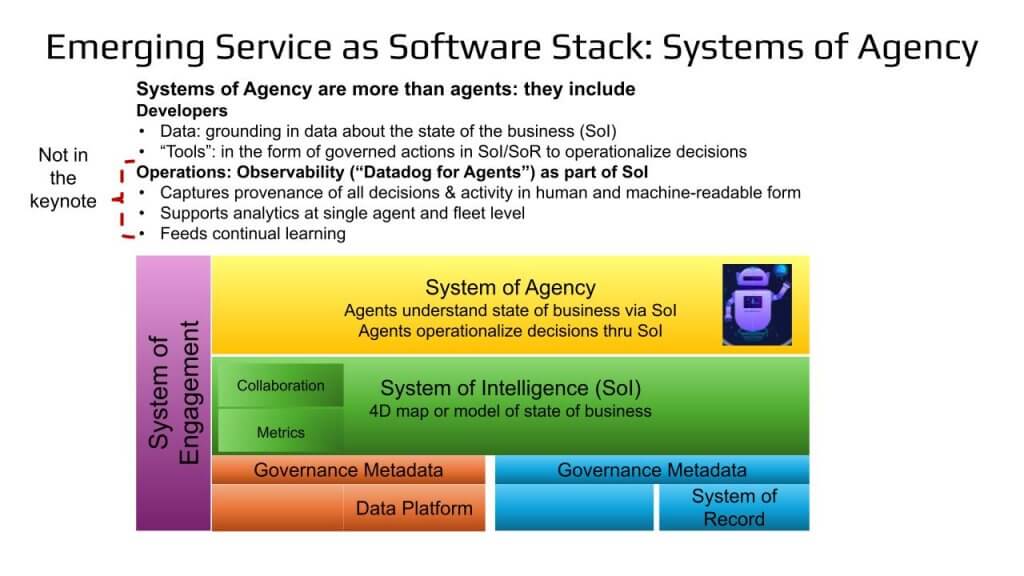

The emerging service-as-software stack: System of intelligence as the important thing enabler

Above we show our view of how the software stack is evolving. The green band is the high value system of intelligence. We’ve discussed this repeatedly as a “4D map” of the enterprise. This section attempts to elucidate why that layer is different from conventional software platforms and why agents deliver declining marginal cost at scale.

Traditional data platforms (the Databricks and Snowflakes of the world) remain a vital contributor as they capture transaction snapshots and event tables streaming out of operational apps. But they often excel at what happened. The SoI re-shapes those raw events to reflect the dynamics of the business by way of causal relationships, constraints, rhythms and allowable actions across time. In our view, the SoI extends the outcomes by addressing what happened, why it happened, what’s more likely to occur and what needs to be done. That makes it a dynamic, four-dimensional map – state + time + causality + policy – slightly than a passive store.

Agents require this mapping. Much like robots navigating a plant floor, enterprise agents must orient (perceive the present state), reason (infer intent and sure outcomes), act (invoke governed tools) and absorb human feedback. And not using a living model of the business, agents either overfit to narrow workflows or devolve into prompt chains, that are brittle. With the SoI, agents inherit shared context, policies and goals, so actions turn out to be consistent, auditable and improvable.

That is how we see the stack evolving, not merely adding a tier. Systems of record remain the singular truth; Systems of engagement remain the human/agent interface. The SoI sits in between, mixing data semantics, business logic and policy right into a control surface that agents can use. Governance, metadata and observability weave through all three layers so every perception, decision and motion is traceable.

We consider the SoI is the high-value real estate since it turns disconnected data and apps right into a navigable, causal map that agents can operate on. That’s the prerequisite for service as software in our view, where outcomes are executed by agents that perceive, determine, act and learn across the enterprise with trust and control.

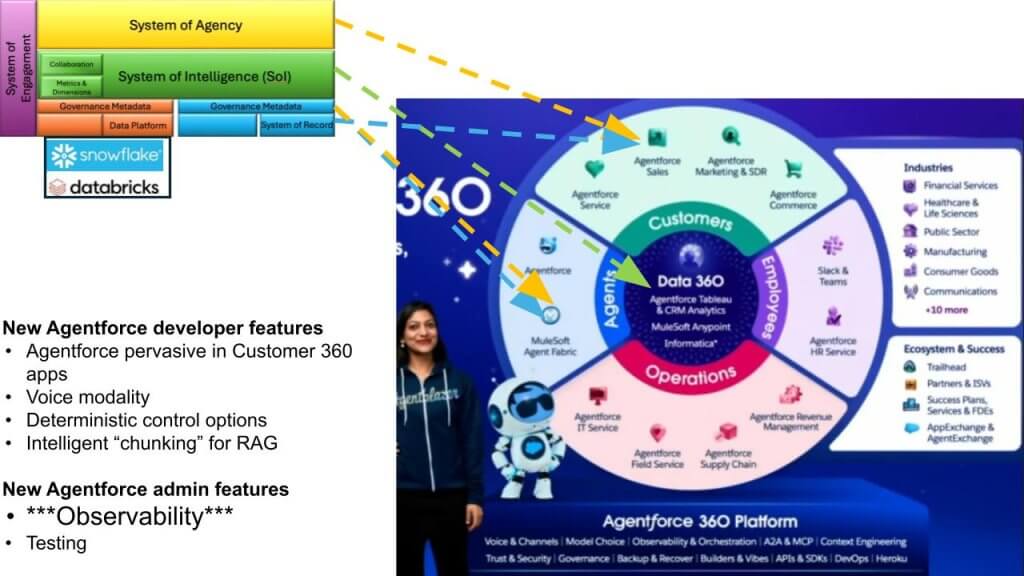

Mapping the stack to Agentforce 360

This next section maps the emerging stack to Salesforce’s Agentforce 360 as shown below. Our view is that a system of agency is way more than a person agent embedded in sales, marketing or sales development representative/business development representative workflows. It’s the agent contained in the app plus the governance fabric, observability, testing and control surfaces that make fleets of agents secure, auditable and scalable.

On this model, the system of intelligence – the green layer – connects on to Data 360, which just isn’t merely an information store but a living model of the shopper profile and engagement journey. That model sits atop a standard data platform. MuleSoft provides the governed bridge back into systems of record to operationalize decisions in legacy applications.

We consider Salesforce’s real play is integrating a system of agency to a system of intelligence so agents can perceive, determine, act and learn across Customer 360 with provenance. The narrative onstage within the keynotes at Dreamforce emphasized recent agent development features, however the durable moat forms in a brand new operations layer that integrates and extends the SoI – that is the scaffolding that sustains day-two scale, specifically:

- Governance and policy enforcement across all agents and actions

- Observability and reasoning traces for provenance and continuous learning

- Testing, versioning and rollback to harden workflows before broad rollout

In our opinion, that is where differentiation will emerge. The market is flooded with agent runtimes and dev tools – “more startups than fleas on the common camel,” as George Gilbert puts it. Most runtimes look similar; what actually separates agents in practice are the tools they’re natively trained to make use of and the context they inherit. In Salesforce’s world, “tools” mean governed actions inside Customer 360 (the verbs that change state) and data from Data Cloud that lets agents perceive the business or customer state accurately. The mix of trusted actions and contextual state is what gives one agent meaningful advantage over one other.

Notably, the keynote spotlighted builder and scripting features but was lighter on the “Datadog-for-agents” side of the story. Our assessment is that Salesforce is folding those operations primitives into the system of intelligence itself. That integration matters because by co-locating observability with the SoI, perception, decision and motion is captured once, governed once and fed back into the training loop. That’s how fleets of agents avoid brittle prompt spaghetti and move from pilots to production.

We consider Agentforce 360’s edge is not going to come from yet one more agent runtime but from scaffolding software – governed actions in Customer 360, Data 360’s business model of the shopper, MuleSoft’s policy-aware integration to systems of record, and SoI-native observability and testing. That’s the path to reliable, at-scale outcomes and the essence of service as software.

Salesforce decision intelligence

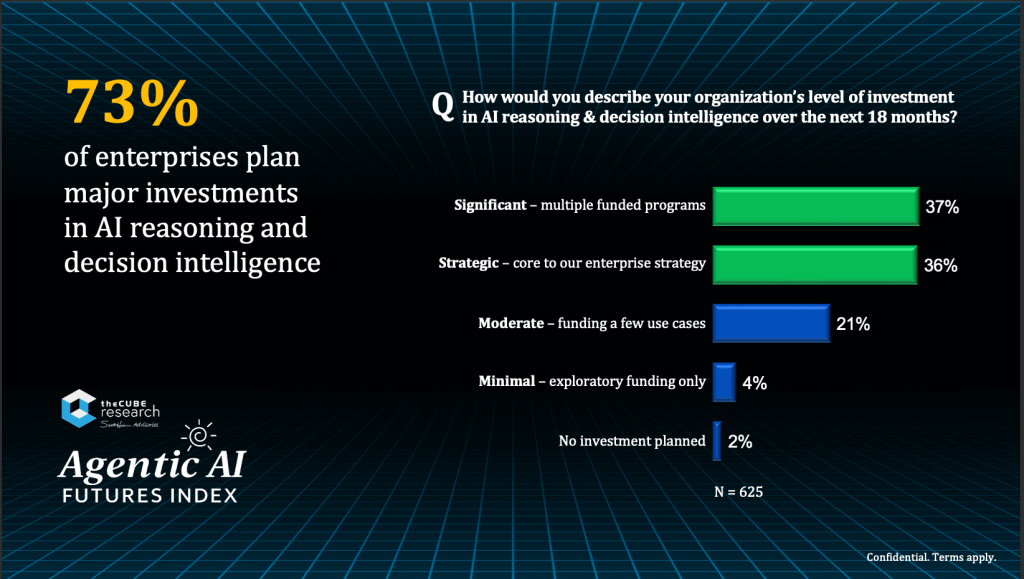

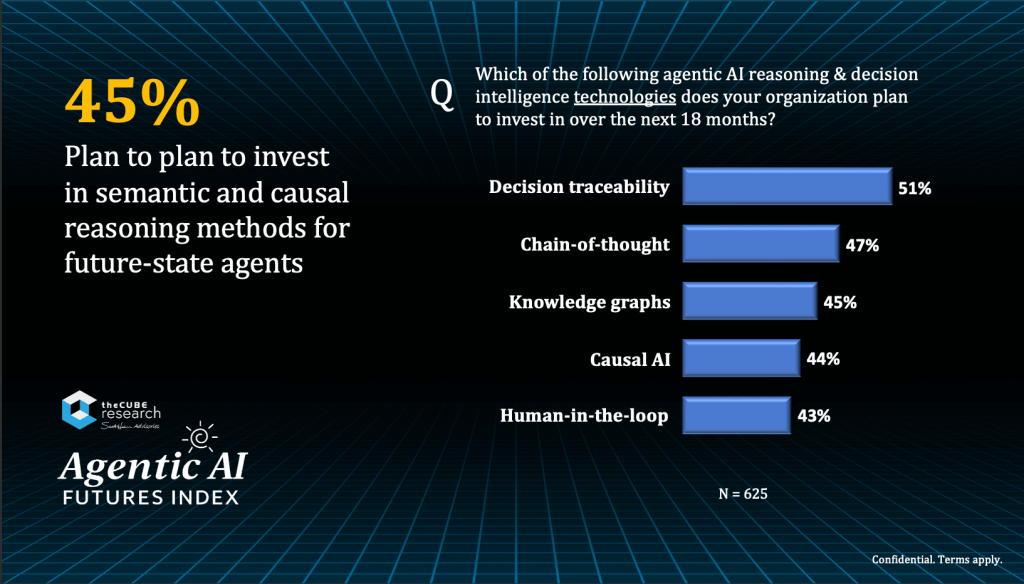

We consider a core enabler is a semantic data fabric in Salesforce 360 that converts enterprise data into dynamic knowledge graphs. This provides crucial context the agents need. Our research indicates demand is real. For instance, as shown above, in a 625-respondent, 13-industry survey, 73% plan to speculate in reasoning/decision intelligence inside 18 months; 36% call it strategic. Today, Einstein’s “what-if” simulations are largely probabilistic and correlation-based, that are useful, but brittle as conditions change. Service as software requires more. Specifically, we call for semantic grounding plus causal models that designate, justify and predict consequences.

As shown below, around 45% of respondents in our survey indicate intent to speculate in chain-of-thought reasoning, knowledge graphs and causal AI. In our view, Salesforce has the pieces (agentic architecture, semantic layer, multimodel ecosystem) but must execute to show them into trustworthy, repeatable decision intelligence at scale.

Systems of agency are greater than agents

Returning to the emerging service-as-software stack, this section isolates the system of agency and clarifies what actually differentiates agents in production. The market is overflowing with agent runtimes and dev tool startups. Most look similar on the core.

We consider the meaningful differentiation is not the agent shell; it’s the native tools and context the agent can wield with governance. In Salesforce’s world, “tools” are the actions inside Customer 360 that really change business state – create, update, approve, fulfill, escalate – and the Data Cloud context that lets agents accurately perceive the state of the shopper and the business. Agents trained to make use of these governed actions against high-fidelity context can operationalize decisions end to finish; agents without them remain clever prompt chains.

Equally vital is the operations layer. The keynote emphasized builder and scripting features, however the decisive capability is what we’d call Datadog for agents – observability, testing, reasoning traces and policy controls – now being folded into the system of intelligence. By embedding operations into the SoI, every perception, decision and motion is captured once, governed once and fed back into the training loop. That’s how fleets of agents avoid brittle behavior and scale safely.

Our view is that production-grade agency equals agents + scaffolding. The winners will pair:

- Governed actions in Customer 360 (the verbs that change state)

- Wealthy context from Data Cloud/SoI (the map that orients decisions)

- SoI-native observability and testing (the feedback that hardens workflows)

That combination, not yet one more agent runtime, is what turns pilots into reliable, scalable outcomes.

The developer perspective

The following section of this post drills into the developer angle. We’ll start with Paul Nashawaty, who runs our AppDev practice, and get his tackle Dreamforce and what it means for developers. After that we’ll rifle through the opposite announcements with quick hits on the announcements – 1) What it’s; 2) Why it matters; and three) A bottom-line takeaway for every.

The developer angle of Agentforce

[Watch Paul Nashawaty’s complete analysis]

Dreamforce 2025 marked a shift from app-centric SaaS to the agentic enterprise – that’s, service as software. We consider the middle of gravity moves from constructing apps to operating systems of motion where agents, grounded in Data Cloud (now called Data 360) and governed workflows, deliver outcomes and learn constantly. Einstein, Data Cloud and Agentforce are converging right into a unified code-and-data fabric; developers shift from writing features to architecting observable, policy-controlled agent workflows.

Heroku is evolving from a developer-friendly PaaS into the agentic stack with open development with enterprise governance, hosting microservices and models, and increasing Agentforce. MuleSoft’s “intelligent integration fabric” becomes the nervous system, with a single control plane (for instance, Anypoint Flexible Gateway) for authenticated, observable application programming interfaces across systems.

Core advantages Salesforce has promised are as follows: Less glue code, faster time-to-value, hybrid low-code/pro-code velocity. The risks Salesforce needs to administer that customers will deal with include the next: ecosystem lock-in, operational complexity and the necessity for rigorous observability, security and governance. In our view, performance, transparency and repeatability are critical as SaSo becomes the operating model for enterprise development.

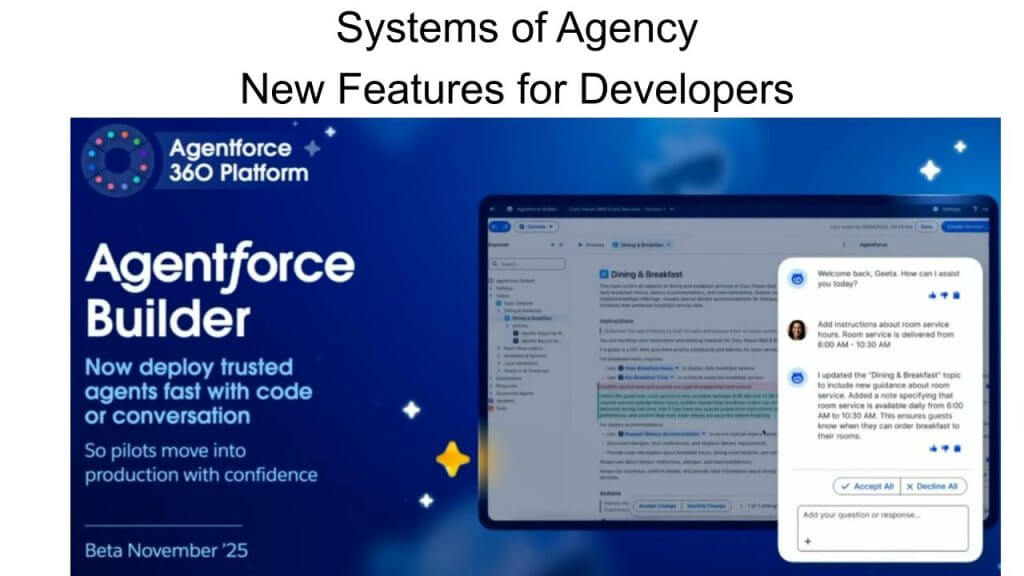

Developer feature: Agentforce Builder

- What it’s: A simplified, low-code experience — plus conversational user interface — for business analysts and AI engineers to assemble agents.

- Why it matters: We consider it shortens time-to-pilot and expands the builder pool without sacrificing governance when paired with Data 360 actions and policies.

- Bottom line: In our view, Builder accelerates creation; day-two value still will depend on observability, testing and governed actions inherited from the broader Agentforce fabric.

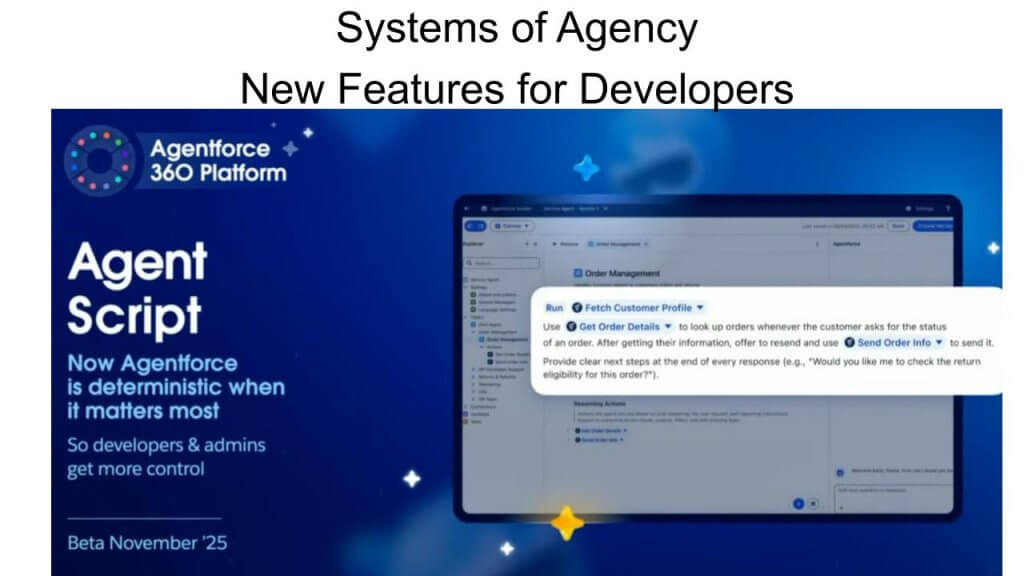

Developer feature: Agent Script

What it’s: A technique to inject deterministic steps into otherwise probabilistic agents — at the duty, process, or multi-agent orchestration level.

Why it matters: Our view is that guardrails, branching logic and required checkpoints reduce variance, improve reliability and make agents enterprise-safe.

Bottom line: Determinism layered onto adaptive agents is how teams move from clever demos to repeatable, auditable workflows.

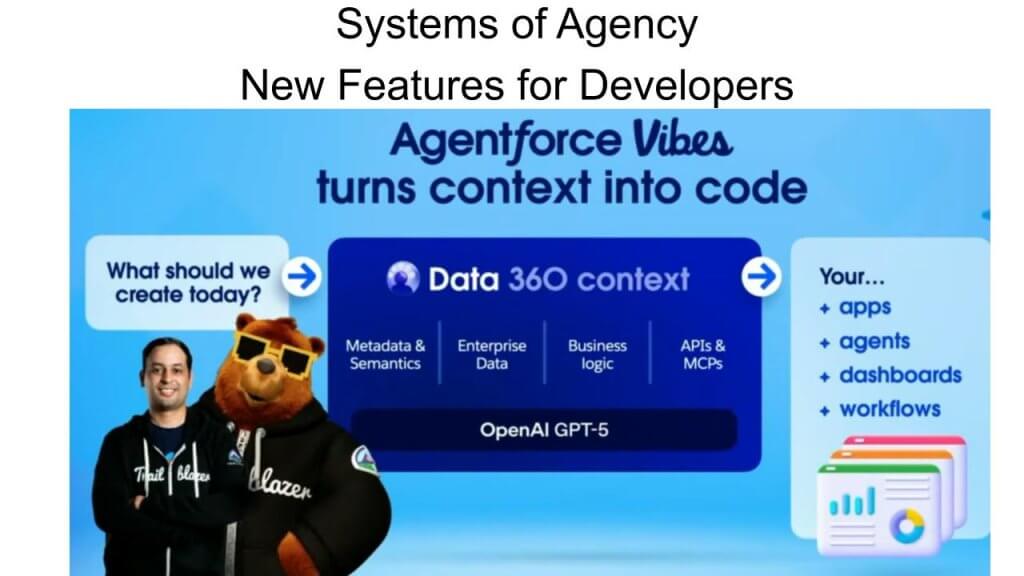

Developer feature: Agentforce Vibes

What it’s: “Vibe coding” brought into Salesforce — using conversational prompts to generate and modify experiences inside Customer 360 data, workflows and agent tools.

Why it matters: Our view is that moving vibe coding from greenfield apps to governed enterprise context makes rapid UX/app iteration practical without abandoning control.

Bottom line: We consider Vibes turns prompt-first creation into production-shaped development by anchoring it to Salesforce data models, actions and policies.

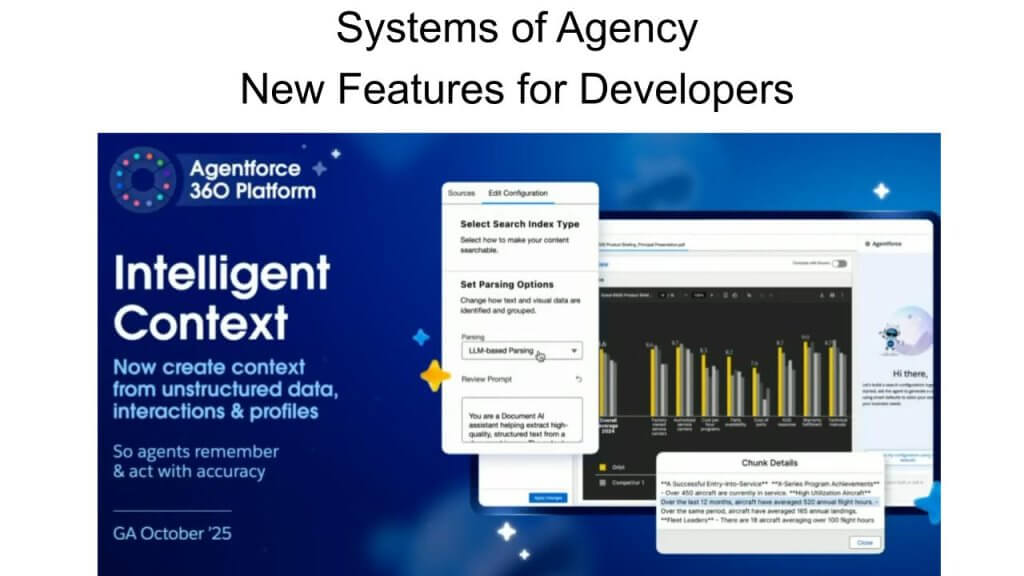

Developer feature: Intelligent context

What it’s: An intent-aware context engine that automates chunking, embedding and retrieval based on the query being asked.

Why it matters: We consider it reduces hallucinations and admin toil by choosing the right spans of text and signals for every query – slightly than counting on brittle, manual chunking rules.

Bottom line: In our view, adaptive context construction is table stakes for reliable agents; it turns generic RAG into fit-for-purpose evidence at runtime.

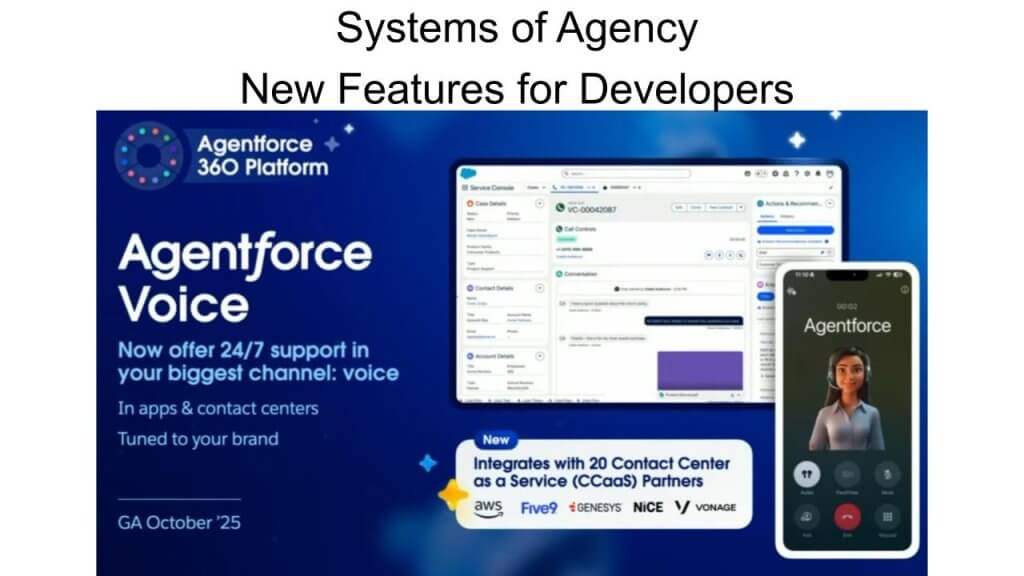

Developer feature: Agentforce Voice

What it’s: Voice-native interaction for Salesforce apps and agents — usable involved centers and by employees to work with customer relationship management hands-free.

Why it matters: We consider it turns after-hours form filling into real-time capture; reps can log activities, update records and trigger actions by talking.

Bottom line: In our view, making voice a first-class modality boosts adoption and data quality while extending agents to where work actually happens.

Agentforce Service + Command Center

What it’s: Salesforce’s flagship Customer Service app agent-enabled with a centralized command center to observe, govern and tune a fleet of agents across systems of record.

Why it matters: We consider that is the bridge from pilots to pervasive agents – giving ops teams levers for policy, routing, escalation and performance while keeping actions grounded in Customer 360.

Bottom line: In our view, embedding agency right into a core app plus fleet management is the Day-2 pattern enterprises have to scale outcomes safely.

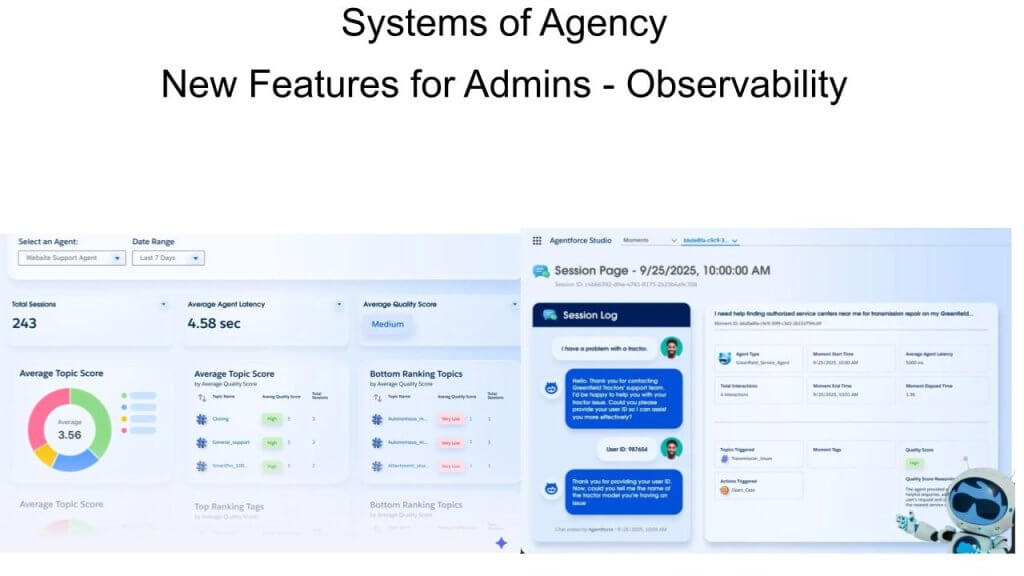

Admin feature – observability: From POCs to operating a fleet

Last 12 months was heavy on proofs of concept and vision; this 12 months Salesforce put day-two operations on the table. The primary admin feature that matters is observability – because once agents are deployed, teams must see what they’re doing, how well they’re doing it, and why.

Traditional analytics focuses on business state – for instance, pipelines, CSAT, resolution times. We consider the agentic era adds a second analytics plane: metrics in regards to the agents themselves. That features health, policy adherence, tool usage, success/failure modes, latency, escalation patterns and final result quality.

Crucially, this just isn’t a sidecar; observability have to be converged with Data 360 so agent telemetry is correlated with customer, case and transaction context. With that integration, admins can move beyond “what happened” to “how the agent decided,” “which actions it took,” and “what should change.” The orchestration view that accompanies observability is equally vital: It treats agents as a fleet (and even a military) that will be routed, throttled or retrained based on live signals. That closes the training loop — telemetry informs tuning, tuning improves outcomes, outcomes feed back into models and policies.

Our view is that observability fused with Data 360 is the day-two control surface. It upgrades BI from tracking the business to tracking the agents that run the business, enabling scalable governance, faster root-cause evaluation and continuous improvement of agent behavior.

Observability, part 2: Aggregate to trace, human to agent

The second observability view matters because admins need two lenses without delay: fleet-level aggregates across many sessions for a given agent type, and instance-level traces – including each human and agent reasoning traces – for a single session.

We consider this dual view is the difference between dashboards that describe and systems that improve. On the aggregate level, teams can spot cohort patterns (tool failure rates by segment, drift by region, latency hot spots, escalation frequency, containment rates), set baselines and run A/B tests on scripts, prompts or policies. On the instance level, reasoning traces expose how an final result was reached: what the agent perceived from Data 360, which actions it invoked, why it branched, and where a human intervened. That combination enables:

- Rapid root cause evaluation (policy mismatch vs. data quality vs. tool error)

- Compliance and auditability (who/what decided, with provenance)

- Targeted retraining (feed specific failure modes back into the SoI)

- Safety and quality gates (block dangerous motion patterns before rollout)

Crucially, each lenses have to be sure to customer and case context so “what happened” lines up with “how the agent decided.” Without that stitching, aggregates are blind and traces are anecdotes.

Our view is that observability only earns its keep when teams can zoom from fleet metrics to a single reasoning path in a single motion. That’s how enterprises tune agents constantly, prove governance, and scale from pilots to dependable, production outcomes.

How CXOs achieve strategic outcomes

Our closing slide below synthesizes the stack and brings together harmonized data and governance; systems of engagement at the perimeters; a system of intelligence inferring context; and, in yellow, a system of agency taking motion through an agent control layer. The aim is to have agents delivering outcomes across silos so CXOs can hit their most strategic objectives.

We consider the vision is credible since it defines who does what at each layer and measures success as outcomes, not app usage. The desiloed posture assumes data platforms participate, engagement systems provide signals, and governance is enforced end to finish. Inside this frame, competitive dynamics center on which vendor could make processes first-class and operate them with agents at scale:

- Out in front: Palantir and Celonis treat business processes as first-class residents with a four-dimensional map of how work flows. They prove the category’s viability and set the production bar.

- Aspirants: Blue Yonder (constructing on RelationalAI with deep supply-chain domain), ServiceNow (extending a workflow data fabric toward the identical goal), SAP Business Data Cloud (entity-centric today – customers, orders, purchase orders – moving toward explicit processes).

- Open query: Oracle has hardware-scaled systems and separation advantages in owned stacks, but, in our view, has not yet shown a credible data-platform entry on this framing that rivals Databricks/Snowflake nor the pull of application logic into the information plane the best way Salesforce is attempting via Data 360 + Agentforce.

For Salesforce specifically, our assessment stays constructive. The 2030 financial framework targets $60 billion organically (before any Informatica implications). Data Cloud 1.0 was rudimentary; this week showed real progress – misfit parts beginning to cohere around a governed SoI and an agency layer.

The principal risk in our view is organizational. Specifically, Salesforce’s muscle memory and street cred are as an application company. Winning the agentic era requires a hybrid identity – apps + platform – and a two-front go-to-market targeting board-level business value and credibility with the IT organization that builds cross-functional agent pilots and runs day-two operations. The brand new IT service offering is strategic not only as product, but as a conduit to earn trust on the IT side of the home. Satirically, we noted during Marc Benioff’s keynote the synergy between Dell Technologies Inc. CEO Michael Dell (IT cred) and Marc (line-of-business affinity).

We consider this will likely be enterprise tech’s best era as experience-curve economics move from consumer online to each company in every industry. The winners will unify apps, data and engagement under a governed SoI, operate fleets of agents with observability and testing, and prove repeatable outcomes at scale before hyperscalers, SaaS peers or open-source ecosystems commoditize the platform.

The easy mandate for CXOs and boards of directors is get on the curve, start learning and dominate.

Disclaimer: All statements made regarding corporations or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are usually not recommendations by these individuals to purchase, sell or hold any security. The content presented doesn’t constitute investment advice and shouldn’t be used as the idea for any investment decision. You and only you’re chargeable for your investment decisions.

Disclosure: Lots of the corporations cited in Breaking Evaluation are sponsors of theCUBE and/or clients of theCUBE Research. None of those firms or other corporations have any editorial control over or advanced viewing of what’s published in Breaking Evaluation.

Image: theCUBE Research/Gemini

Support our mission to maintain content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

- 15M+ viewers of theCUBE videos, powering conversations across AI, cloud, cybersecurity and more

- 11.4k+ theCUBE alumni — Connect with greater than 11,400 tech and business leaders shaping the long run through a novel trusted-based network.

About SiliconANGLE Media

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our recent proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to assist technology corporations make data-driven decisions and stay on the forefront of industry conversations.