PHILIPPINE FACTORY activity in January expanded at its fastest pace in nine months amid a rise in production and recent orders, S&P Global said on Monday.

Nonetheless, the newest improvement may very well be short-lived as business confidence remained weak as a result of concerns about external demand as the worldwide economic environment stays fragile.

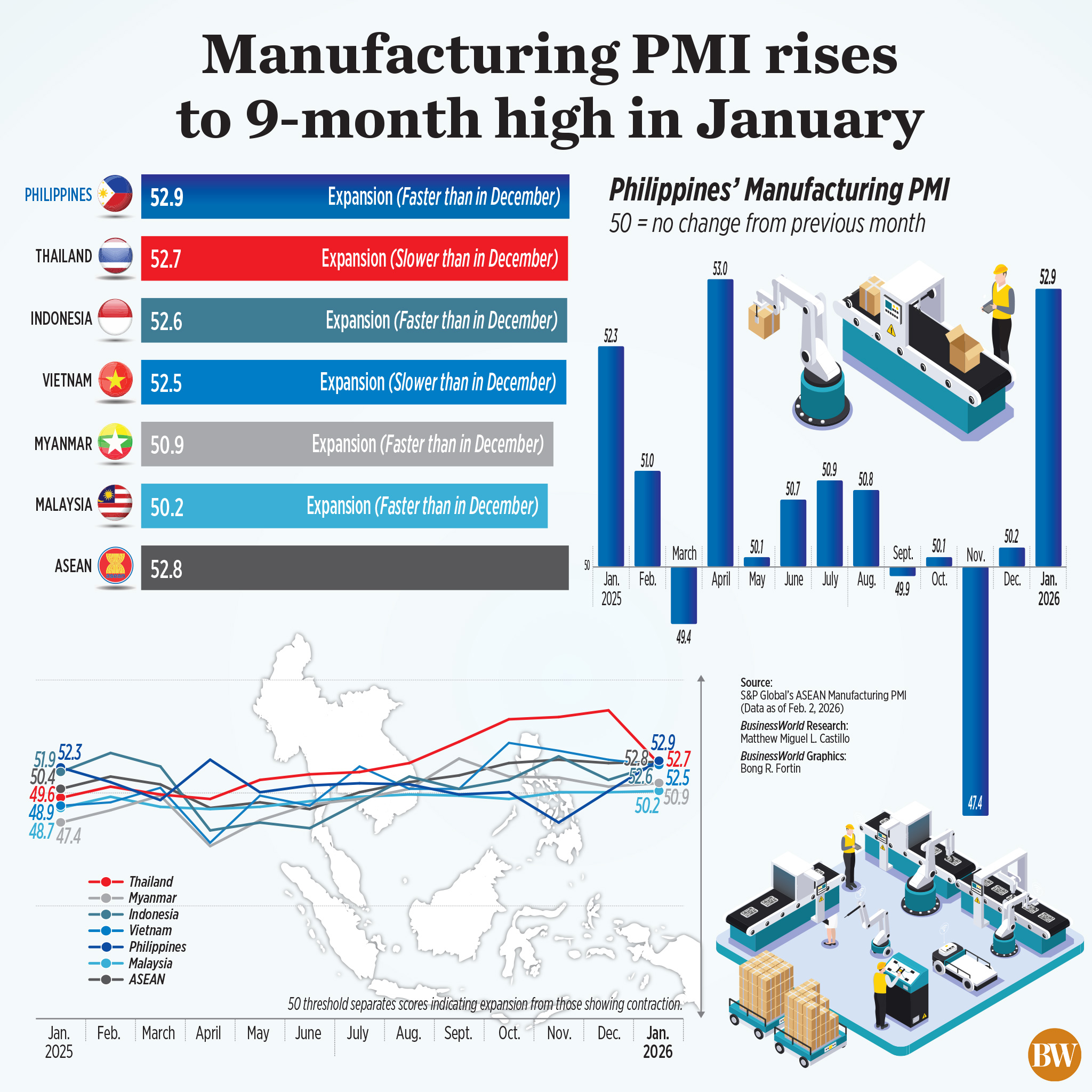

S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) rose to 52.9 in January from 50.2 in December, the strongest improvement in nine months or since April’s reading of 53.

A PMI reading above 50 denotes higher operating conditions than within the preceding month, while a reading below 50 shows deterioration.

“A renewed and powerful uptick in output and faster growth in recent orders contributed positively to the rise within the headline figure,” S&P said. “In accordance with anecdotal evidence, strengthening underlying demand trends supported the newest uptick in recent sales, which then fed through to a renewed rise in production levels.”

The Philippines recorded the fastest expansion in manufacturing activity within the Association of Southeast Asian Nations (ASEAN) region in January, based on S&P’s ASEAN PMI data, beating Thailand’s 52.7, Indonesia’s 52.6, Vietnam’s 52.5, Myanmar’s 50.9, and Malaysia’s 50.2.

The ASEAN Manufacturing PMI picked as much as 52.8 in January from 52.7 in December on the back of strong growth in recent orders.

“After a chronic period of subdued growth within the second half of 2025, the primary PMI data release for 2026 points to a marked shift in momentum,” Maryam Baluch, an economist at S&P Global Market Intelligence, said within the report.

“Latest orders registered a powerful and accelerated uptick, supported partially by a renewed rise in export demand,” she added. “Consequently, production returned to expansion territory for the primary time in five months.”

S&P said the expansion in overall orders was backed by a “modest” increase in recent factory orders received from abroad, which marked the primary month of expansion since September last yr.

With these recent orders driving production, higher production requirements led to increased staffing levels, snapping a two-month decline in job creation. “Although the pace of expansion was slight, it was the fastest since last June.”

“The recent uptick in employment allowed Filipino manufacturers to cut back backlogs of labor firstly of the yr. The speed at which work-in-hand contracted was marginal but marked the primary reduction in three months.”

Increased output requirements also led manufacturing firms to ramp up their purchasing activity, posting the fastest growth in 12 months, S&P said.

“Moreover, firms highlighted their preference of stockbuilding in January as holdings of inputs rose for the primary time in three months. Meanwhile, post-production inventories were also raised and for a second a straight month,” it said.

Meanwhile, producers’ operating expenses rose last month as a result of higher prices of raw materials, although input price inflation was broadly unchanged from December. This led manufacturing firms to barely raise their goods’ prices.

Corporations also reported longer input lead times in January, showing continued supply chain pressures, S&P said.

WEAK CONFIDENCE

Nonetheless, despite the upper headline PMI figure in January, Ms. Baluch said the info showed a “worrying” decline in business confidence about future output.

“Overall sentiment slipped to the second-weakest level on record, surpassing only that seen on the onset of the COVID-19 pandemic. This hesitancy reflects lingering concerns regarding export demand and the sustainability of the newest improvement,” she said.

While corporations remained hopeful that demand would improve, economic uncertainties in key export markets dampened confidence, S&P added.

S&P Global Market Intelligence Economics Associate Director Jingyi Pan said improved factory activity within the Philippines and across ASEAN to start out the yr is a “promising sign,” at the same time as worries remain.

“Allow us to recall that January has been one other month where geopolitical concerns have actually spread across the globe. Then, on that end itself, I feel that’s something to be aware of. But what I feel as well that we have now seen, as I discussed, the employment index, there was a renewal and growth of employment. So, the companies themselves are apprehensive, but they’re still hiring. They’re beginning to buy inputs again,” she said in an interview on Money Talks with Cathy Yang on One News on Monday.

“If the employment index doesn’t pick up alongside demand, if the stocks of purchases should not picking up, that’s after we are getting somewhat bit more apprehensive. But I feel immediately, it’s more of a wait and see… So, from that perspective, I feel it’s telling us that they’re still willing to speculate to some extent, though they’re apprehensive about how much production growth could actually materialize in 2026.”

She said they expect industrial production to rebound this yr after a weak fourth quarter.

Rizal Industrial Banking Corp. Chief Economist Michael L. Ricafort said higher weather conditions and fewer disruption could have contributed to increased production firstly of the yr.

He added that further monetary easing here and abroad could provide a lift to manufacturers as lower borrowing costs will help them finance their operations and potential expansion.

Restocking after the vacations and other seasonal aspects likely propped up factory activity last month, which suggests the January high could simply be a “blip,” especially amid the Philippine economy’s dismal performance last quarter, Filomeno S. Sta. Ana III, coordinator of Motion for Economic Reforms, said.

“What’s most concerning is the slump in business confidence despite the pickup in output in January 2026. That weak business confidence will predict future performance,” he said. — Aubrey Rose A. Inosante