If you would like to process online payments through your ecommerce store, you wish a payment gateway. It’s the technology that securely collects a client’s financial information and passes it onto the processor that transfers money from their account to yours.

There are various payment gateways to select from—each has its own benefits and drawbacks.

When you’re stuck on which one to decide on, we’ve done the hard give you the results you want. This guide rounds up the very best payment gateways ranked by their use case, pros, cons, and pricing so you’ll be able to select the correct one for what you are promoting.

What’s a payment gateway?

A payment gateway is a sort of technology that helps retailers process payments from their customers. The gateway securely transmits and encrypts payment information, resembling a customer’s bank card number and billing address, which is passed from the shopper’s browser to your ecommerce website.

How do payment gateways work?

Payment gateways might sound technical, but we are able to break down their role into just a few key steps:

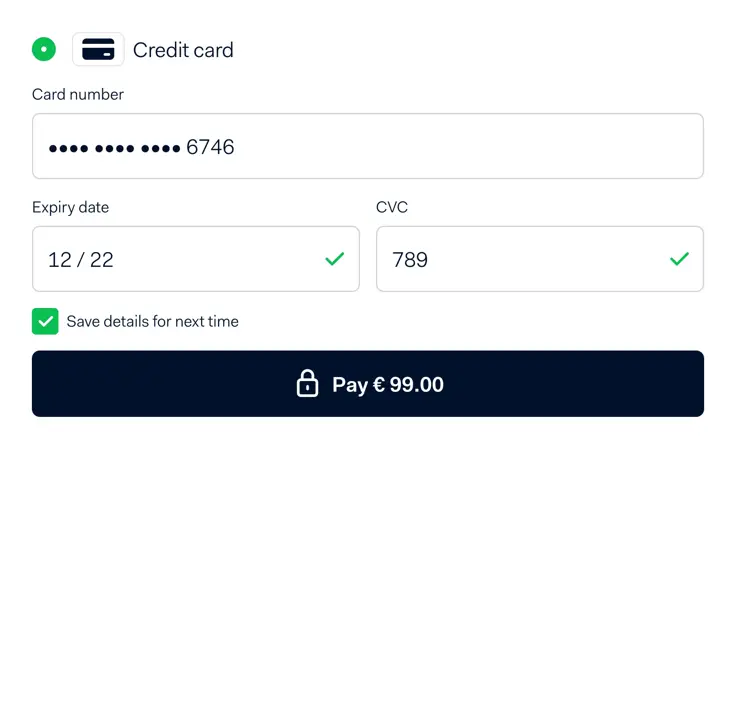

- A customer initiates payment in your website (often on a checkout page).

- The client enters their payment details into the payment gateway. This step can take many forms, including manually entering their details or using a mobile wallet like Shop Pay, Google Pay, or Apple Pay.

- The payment gateway encrypts the info your customer has entered so hackers cannot intercept it.

- The gateway securely forwards this information to the payment processor or acquiring bank, who then sends an authorization request to the shopper’s card network, resembling Visa, Mastercard, or American Express. Then, the cardboard network routes it to the shopper’s issuing bank.

- The issuing bank approves or rejects the request and sends this response back to the payment gateway. You may see this in your ecommerce platform for either consequence.

- If the payment is approved, the payment processor facilitates the move of cash from the shopper’s account to your merchant account. If it’s denied, the payment gateway shows the rationale why. Insufficient funds, fraud risks, and invalid cards are common culprits.

The 6 top payment gateway providers

1. Shopify Payments

Best for: Shopify merchants

Shopify Payments is Shopify’s own payment gateway that enables ecommerce merchants to process online and in-person payments through a single platform. Shopify Payments complies with Payment Card Industry Data Security Standard (PCI DSS) to guard your customer’s data.

Shopify’s payment gateway is compatible with a wide range of sales channels, so you’ll be able to take payments through Facebook, Instagram, and Google. As well as, current Shopify Plus merchants can make the most of lower payment fees for transactions accomplished through Shopify Payments, leaving more profit in your pocket.

Pros of Shopify Payments

- No extra software required to process online payments

- Competitive payment processing fees

- PCI DSS compliant to guard sensitive financial data

- Accept multiple payment methods, including bank cards, digital wallets, Shop Pay, buy now, pay later, and PayPal

- Process international payments in your customer’s local currencies

- Intuitive financial reporting tools baked into your Shopify dashboard

- 24/7 customer support available

- Automatic deposits to withdraw money out of your Shopify admin to what you are promoting checking account

Cons of Shopify Payments

- Only available to Shopify merchants

- Extra fee for transactions made through third-party payment gateways for merchants that aren’t using Shopify Plus

Pricing: Shopify’s payment processing fees differ depending in your plan. This varies between 2.9% and a pair of.4%, plus a 30¢ fee per transaction.

2. Stripe

Best for: Merchants offering subscriptions

Stripe is some of the popular payment gateways since it’s not tied to a selected ecommerce platform. It allows merchants to just accept bank card payments and mobile payments, and is straightforward to integrate with most web sites and mobile apps.

It offers advanced customization and is extremely flexible, but additionally requires more technical knowledge to configure and use. Stripe also includes features for invoicing, subscriptions, and international marketplaces.

Pros of Stripe’s payment gateway

- PCI DSS compliant

- Customization features to brand the payment experience

- Supports a lot of countries and currencies

- Automatic currency conversion to process international payments

- Subscription billing features to process recurring payments and safely store card details

- Comprehensive financial reporting tools

Cons of Stripe’s payment gateway

- Requires more technical expertise for setup and usage

- Support documentation may be very technical

- High chargeback fees if a customer disputes their payment

Pricing: Stripe has a regular payment processing fee of two.9% + 30¢ for transactions made using cards and wallets. There are extra fees for manually entered cards (0.5%), currency conversions (1%), and international cards (1.5%).

3. PayPal

Best for: Businesses with a world customer base who’ve PayPal wallets

PayPal is one other popular payment gateway that enables anyone to process payments over the web. It’s a well-known name on the earth of online payments and has protection programs to insulate each buyers and sellers from fraud. The most important downside is the indisputable fact that it’s dearer than other payment gateways, especially in the event you’re processing payments at scale.

Pros of PayPal’s payment gateway

- Popular and reliable service; the globally recognized brand might influence customer trust and conversion rates

- Invoicing capability

- Buyer and seller protection programs to stop fraud

- One-touch checkout to enhance the shopper experience

- Supports international payments in a variety of currencies

- Customers can use money of their PayPal account to pay for his or her orders

- No setup fees

Cons of PayPal’s payment gateway

- Separate setup and checkout process required

- Customer support is just not the best

- Charges additional transaction fees

- Higher transaction fees than alternative payment gateways

- Some merchants report that PayPal has unexpectedly locked their accounts and frozen their funds

Pricing: PayPal takes 3.49% of the transaction, plus a 49¢ fee. Merchants processing international payments are subject to a different 1.5% fee on top of the fundamental transaction fee, plus a set cost for the actual currency.

4. Adyen

Best for: Large online businesses

Adyen is a world payment gateway that enables merchants to process payments in various currencies and countries. It’s option to think about if subscriptions and international payments are vital to you.

Pros of Adyen’s payment gateway

- A lot of payment options to process international payments, including digital payments, local payment methods, and all major bank cards

- Omnichannel support to take payment across multiple regions via a single integration, online or offline

- 24/7 customer support

- Create branded physical and digital cards

- Choice to create a test account before committing to its payment gateway

- AI-powered risk evaluation system to guard what you are promoting against fraud

- Support for subscriptions and recurring payments

- Process secure transactions anywhere, including online, through a mobile app, and in-store, with tokenization

- Fixed payment processing fees for every payment method

Customizable dashboard to trace payments across all channels Cons of Adyen’s payment gateway

- Not the very best option for smaller online businesses

- Limited customization features

- Pricing model is more complicated than other payment gateways

Pricing: Adyen doesn’t charge monthly fees, but the price of its payment gateway is dependent upon your customer’s issuing bank. This ranges from 3% to 12%, plus 13¢.

5. Authorize.net

Best for: Retailers with a Visa merchant account.

Authorize.net might be an option in the event you need a payment gateway that’s compatible along with your Visa merchant account. The software is owned and operated by Visa, which makes it easy to sync your payment gateway along with your Visa merchant account.

Pros of Authorize.net’s payment gateway

- High uptime rates

- Very user-friendly and good for non-technical merchants

- Accept payments through credit or debit card, checks, PayPal, and Apple Pay

- Advanced fraud detection to dam fraudulent online transactions

- Choice to send invoices to customers using the identical payment gateway

- Customizable payment forms

Cons of Authorize.net’s payment gateway

- Monthly subscription required

- The interface looks outdated in comparison with other gateways

Pricing: Authorize.net’s pricing is dependent upon whether you would like to use just the payment gateway or its merchant account, too. For just the payment gateway, you’re a $25 monthly subscription fee plus a ten¢ + 10¢ every day batch fee.

6. WorldPay

Best for: Merchants that process international payments.

WorldPay is a payment service provider that has its own gateway. The most important pull is that WorldPay Connects with a wide range of global banks and partners to process international payments. Nonetheless, that is reflected in its transaction fees.

Pros of WorldPay’s payment gateway

- Suitable for businesses of all sizes

- Very customizable and versatile

- Excellent security measures, including OmniShield, to guard payment information

- Accepts over 300 payment methods and multiple currencies

- Connects with a wide range of global banks and payment partners to process international payments

- 24/7 customer support

- No monthly subscription fee

Cons of WorldPay’s payment gateway

- Pricing information is just not transparent for issuing card networks like American Express and Discover

Pricing: WorldPay’s pricing is dependent upon the payment method your customer has chosen. This ranges between 0.75% and a pair of.75%.

How you can select a web-based payment gateway provider

Payment processing fees

Before choosing a specific gateway, evaluate the processing fees for several types of transactions. This includes:

- Different payment methods

- The client’s issuing bank (American Express tends to have a better fee)

- International payments and currencies

Small fees can add up over time. When you’re processing $50,000 through the payment gateway per 12 months, for instance, a 2.4% fee would total $1,200 in transaction fees. When you go to the upper end and commit to a 3.49% fee, that’s an additional $545 you’ll spend on payment processing over your entire 12 months.

Payment methods

Did you recognize that 11% of web shoppers have abandoned their online shopping carts since the retailer didn’t accept their preferred approach to payment? By selecting a gateway that accepts a wide range of payment options, you can reduce cart abandonment and shut more sales. That features:

Some payment methods are more popular than others in specific countries. When you’re selling in China, for instance, make certain that your gateway can process WeChat payments. Some 920 million people in China use this payment method to purchase products online.

Security

Payment gateways handle sensitive financial data that you just don’t want falling into the unsuitable hands. Check that your shortlisted payment gateway is PCI DSS compliant and has security measures like encryption and tokenization. These industry standards set the tone for payment security and protect each yours and your customer’s data when processing online payments.

Integrations

Running a business is tough enough already. As a substitute of putting pressure on yourself to get your systems integrated, allow them to do the exertions by selecting a payment gateway that integrates along with your existing tech stack. This includes:

- Your ecommerce platform

- Point of sale software in the event you also sell in-person

- Inventory management systems

- Subscription management apps

- Accounting software

- Analytics apps

Reliability

A reliable payment gateway keeps you open for business every time your customers need to buy. Before committing to a payment gateway, check their uptime reports. The upper this percentage, the higher.

In case your gateway is repeatedly experiencing technical difficulties, you’ll not only lose money, but you’ll deliver a negative customer experience. This alone can deter people from returning: 86% of individuals will leave a trusted brand after a single poor experience.

Customer experience

Customers will probably be interacting along with your payment gateway on daily basis. The more nice that have is, the more likely they’ll be to finish their purchases, and likewise proceed placing orders with what you are promoting.

An important checkout experience involves:

- Accepting a wide range of payment methods

- Functioning well on all devices, including desktop, mobile, and tablet

- A recognizable payment gateway provider they know and trust

- Security or trust signals, resembling PCI DSS compliance logos

- Reliable customer support

Select the very best payment gateway provider for what you are promoting

Selecting a payment gateway to your online business is a giant decision. Not only is your customer experience at stake, but payment processing fees can quickly eat into your profit margins.

When you’re already running what you are promoting on Shopify, the platform’s own payment gateway is a no brainer. There’s no need to search out a third-party provider that connects along with your store, nor compare payment processing fees. You’ll be able to do it multi functional place.

Payment gateway providers FAQ

Which is the very best payment gateway?

- Shopify Payments for ecommerce stores

- PayPal for merchants whose customers use PayPal’s digital wallet

- Stripe for merchants selling subscriptions with recurring payments

- Adyen for omnichannel payments with fixed processing fees

- Authorize.net for Visa merchant accounts

- WorldPay for international payments

What’s a gateway payment provider?

A gateway payment provider is a sort of software that may encrypt sensitive payment information. These firms help online retailers that need to process online and in-store payments through their ecommerce platform.

Is PayPal a payment gateway?

PayPal is a payment gateway that enables merchants to soundly collect payments from their customers.

What’s the best payment gateway to establish?

Shopify is the best payment gateway to establish in the event you have already got a Shopify store. You don’t need to search out third-party software; just toggle the payment gateway on inside your Shopify admin.

What’s probably the most used payment platform?

PayPal is the world’s most used payment platform. It processes over 200 billion transactions per 12 months, and is utilized by 36 million merchants who process online payments from 431 million users.