By Revin Mikhael D. Ochave, Reporter

WEST ZONE concessionaire Maynilad Water Services, Inc. said it plans to boost as much as P49.15 billion through an initial public offering (IPO) inside the subsequent two quarters.

The IPO’s indicative terms include a base offer of as much as 1.81 billion common shares, an overallotment option of as much as 266.31 million common shares, and an upsize option of as much as 379.29 million common shares, with a proposal price of as much as P20 apiece, Maynilad said in a disclosure to the Philippine Dealing System Holdings Corp. dated March 14.

Maynilad’s board, led by Metro Pacific Investments Corp. (MPIC), approved the IPO’s registration and offering during a gathering on March 14.

“It [IPO] needs to be in the subsequent two quarters,” Maynilad President and Chief Executive Officer Ramoncito S. Fernandez said during a media briefing in Pasig City last week.

“The corporate is preparing in order that it could possibly be push-button (ready) inside this yr, depending on various factors like macroeconomic and geopolitical. That’s where we’re today,” he added.

Asked about possible delays, Mr. Fernandez said the “sweet spot” for Maynilad’s IPO is that this yr.

“If we push it next yr, we may be running out of options already. The sweet spot, really, is that this yr,” he said.

“We have already got banks helping us. Now we have HSBC, Morgan Stanley, UBS, and Bank of the Philippine Islands assisting us,” he added.

Signed into law on Dec. 10, 2021, Republic Act No. 11600 granted Maynilad a 25-year legislative franchise until 2047 to ascertain, operate, and maintain a waterworks system, in addition to sewerage and sanitation services, within the West Zone service area of Metro Manila and Cavite province.

The law also mandates that Maynilad must offer at the very least 30% of its outstanding capital stock inside five years from the franchise grant.

“That is the type of IPO that may potentially do well amid current market conditions. Maynilad can be thought to be a defensive stock and a dividend play, so it’s something many institutional and retail investors would consider buying. It also helps the IPO story that they got an enormous earnings boost last yr mainly on account of tariff adjustments,” China Bank Capital Corp. Managing Director Juan Paolo E. Colet said in a Viber message.

“I feel the offer shares could be fully taken up since this can be marketed to each offshore and domestic investors. Having a powerful syndicate of foreign and native banks to support the deal can be very necessary to its success,” he added.

In 2024, Maynilad’s core net income grew by 40% to P12.8 billion on account of lower operating expenses. Revenue rose by 23% to P33.5 billion, driven by tariff adjustments and better billed volumes.

“Based on its indicative terms, Maynilad could potentially raise as much as P49 billion, assuming the very best offer price and full exercise of all share options. This fundraising exercise will support Maynilad’s expansion plans, because it has earmarked at the very least P30 billion for capital expenditures (capex) in 2025,” Unicapital Securities, Inc. Equity Research Analyst Peter Louise D.C. Garnace said in a Viber message.

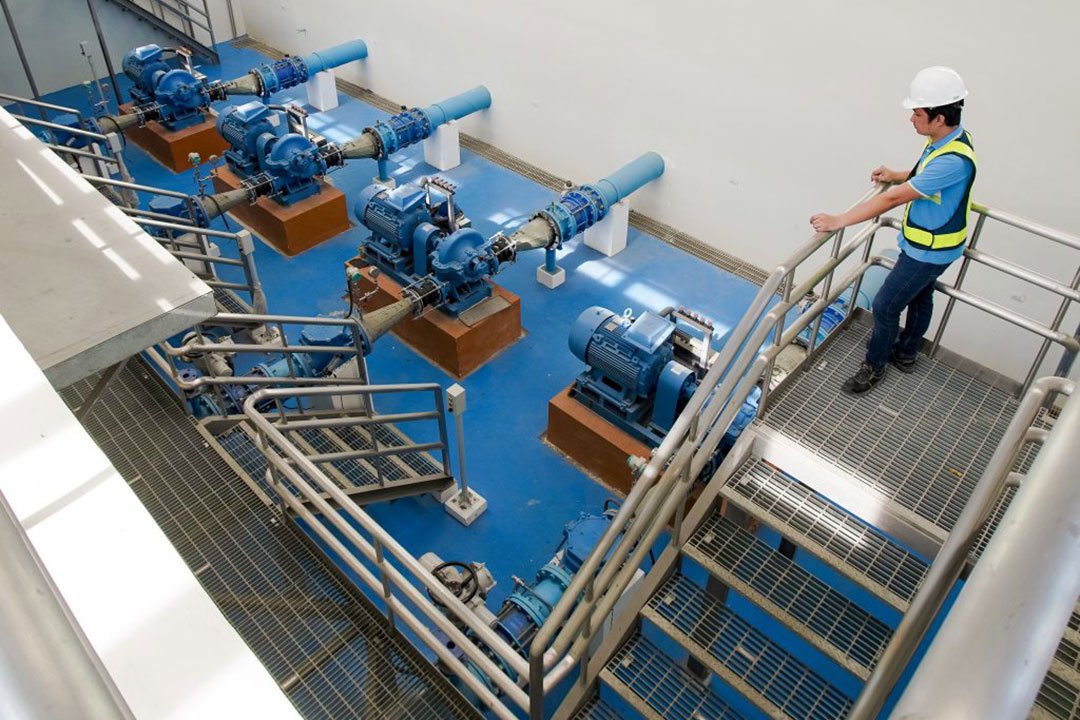

Maynilad previously said its 2025 capex budget could exceed P30 billion, allocated for water and wastewater projects, non-revenue water management programs, and ongoing plant construction.

The corporate spent P25.75 billion in 2024 to upgrade its water and wastewater infrastructure.

Maynilad is amongst six IPOs expected on the Philippine Stock Exchange (PSE) this yr.

“Market conditions improved recently, with the PSE index (PSEi) at 1.5-month highs, alongside some net foreign buying over the past two weeks. A stronger PSEi and continued net foreign buying would support the next share price, maximizing proceeds for the issuing company,” Rizal Business Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

“Stable to improving market conditions, shaped by each local and external aspects, can even determine demand for the share sale, especially if investors see market gains,” he added.

Maynilad serves parts of Manila, Quezon City, and Makati, in addition to Caloocan, Pasay, Parañaque, Las Piñas, Muntinlupa, Valenzuela, Navotas, and Malabon. It also supplies water to Cavite City, Bacoor, and Imus, together with the towns of Kawit, Noveleta, and Rosario in Cavite province.

MPIC, which holds a majority stake in Maynilad, is one in every of three Philippine units of Hong Kong-based First Pacific Co. Ltd., alongside Philex Mining Corp. and PLDT Inc.

Hastings Holdings, Inc., a unit of PLDT Useful Trust Fund subsidiary MediaQuest Holdings, Inc., has an interest in BusinessWorld through the Philippine Star Group, which it controls.