Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favourite stories on this weekly newsletter.

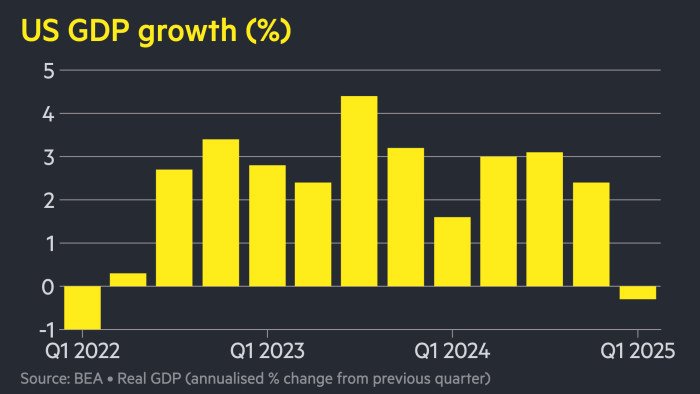

The US economy contracted by an annualised 0.3 per cent over the primary quarter, as firms on the planet’s largest economy responded to Donald Trump’s trade war by rushing to import goods.

The autumn within the GDP reading — the primary since 2022 — was worse than economists’ most up-to-date forecasts and compared with the two.4 per cent rise recorded for the fourth quarter.

It was largely the results of US firms’ rush to purchase goods from abroad ahead of Trump’s sweeping tariffs, with imports rising at an annualised rate of 41 per cent.

But many analysts argued that the headline GDP number was principally brought down by a rare recent increase within the US trade deficit, quite than reflecting underlying trends.

The calculation used for Wednesday’s figure arrives at GDP by subtracting imports from total spending, including domestic consumption, investment and exports.

Morgan Stanley economists said the surge of imports ultimately contributed to inventories, consumption and investment — positive aspects in calculating GDP that weren’t fully reflected in Wednesday’s data.

“In effect, the imports don’t fully appear within the spending parts of the GDP accounts and subsequently exaggerate GDP weakness,” they said.

Some economists focus as a substitute on other measures, corresponding to investment and consumer spending.

Wednesday’s figures showed that the sum of consumer spending and gross private fixed investment increased 3 per cent in the primary quarter, up on the previous rate of two.9 per cent.

In a post on his Truth Social network, Trump suggested the figures had “NOTHING TO DO WITH TARIFFS”.

Blaming former president Joe Biden, he added: “I didn’t take over until January twentieth . . . When the boom begins, it’s going to be like no other. BE PATIENT!!!”

Acknowledging the stockpiling that took place ahead of Trump’s tariffs announcement this month, the Bureau of Economic Evaluation, which produced Wednesday’s data, highlighted the rise in “private inventory investment”.

Without this contribution, the GDP figures would have contracted at an annualised rate of two.5 per cent.

In an additional indication of the dimensions of business’s efforts to import ahead of the tariffs, the US goods trade deficit reached a record high of $162bn for March in figures published this week.

Economists anticipate some rebound within the second quarter as imports fall and previously stockpiled foreign goods are bought by US consumers.

Gregory Daco, chief economist at EY-Parthenon, said that firms’ “frontloading of orders to get ahead of tariffs” had “created a large shock to GDP”.

But he referred to the aspects behind Wednesday’s GDP figure as “unprecedented distortions” that were unlikely to vary the Federal Reserve’s calculations in regards to the underlying performance of the US economy.

Although the products trade deficit dragged down the general GDP figure for the quarter, this was partly offset by businesses spending on stockpiling.

Stock futures dropped and bond yields rose barely following the info. The 2-year Treasury yield, which moves with rate of interest expectations, was up 0.01 percentage points to three.66 per cent.

There was no significant shift in rate of interest cut expectations following the info, with traders within the futures market still pricing in roughly 4 cuts this yr.

The Bureau of Economic Evaluation said the autumn in output for the primary quarter also reflected a decline in government spending.

It added that consumer spending was also among the many aspects that partly, but not wholly, offset the rise in imports and the autumn in government spending.

“The strong domestic demand figures are a poignant reminder of what may need been a graceful soft landing until the sweeping tariffs threw the economy astray,” said Eswar Prasad, professor at Cornell University.

Trump’s trade war is predicted to guide to slower growth over the second half of this yr, with higher prices weighing on consumption.

The IMF said last week that US GDP would expand by 1.8 per cent this yr — down from its January estimate of two.7 per cent. Many private sector forecasters predict no growth in any respect.

Additional reporting by Kate Duguid in Recent York