By Mon Abrea, Global Tax Policy Expert and Chief Tax Advisor, Asian Consulting Group

Businesses — from small entrepreneurs to major corporations — are respiratory a sigh of relief after President Ferdinand Marcos, Jr. ordered the Bureau of Internal Revenue (BIR) to redirect its audit and enforcement efforts toward those implicated within the multibillion-peso flood-control corruption scandal.

The President’s instruction is greater than a response to a scandal — it’s a signal that the federal government is finally listening. For years, reform advocates have urged the BIR to stop harassing compliant taxpayers and as an alternative concentrate on high-risk, high-impact investigations where corruption and tax evasion converge.

This shift, if sustained, could mark essentially the most significant turning point within the country’s tax administration because the TRAIN Law. It’s time to institutionalize this approach — to make accountability, not extortion, the core of the BIR’s audit culture.

Fixing a Broken Audit System

The BIR’s own data tells a troubling story: lower than 3% of total revenues come from audits. Despite that, most audits goal micro, small, and medium enterprises (MSMEs) — the simplest to intimidate however the least more likely to cheat.

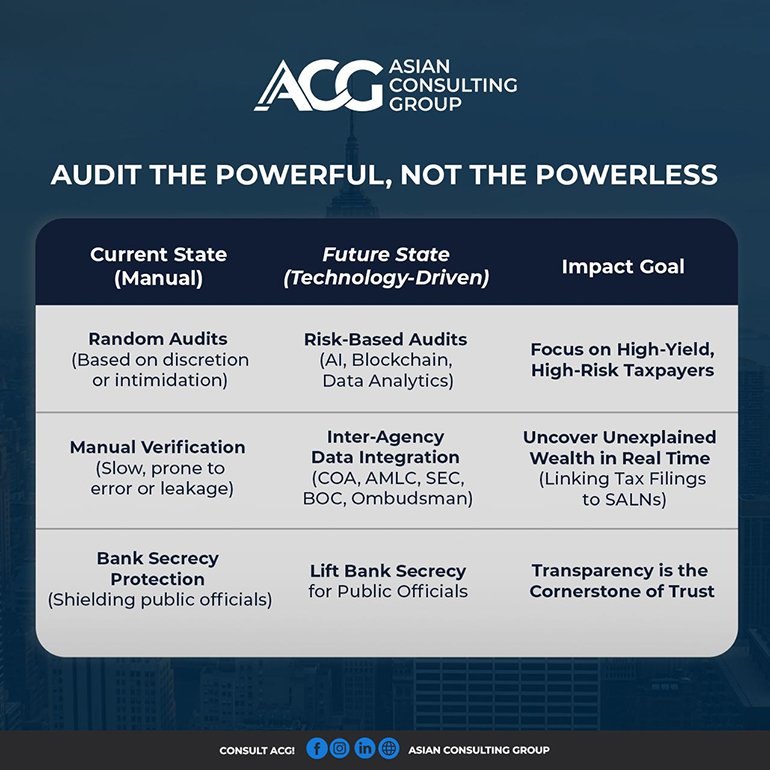

Random, manual audits have bred inefficiency and corruption. Some examiners allegedly use their power to solicit bribes for “settlements,” turning the audit process right into a revenue leak as an alternative of a revenue source. The result: compliant taxpayers lose confidence, while politically connected tax evaders remain untouched.

Redirecting audit efforts toward those linked to government anomalies is the correct move. But to make sure this will not be only a one-off campaign, the BIR must adopt risk-based, technology-driven systems that remove discretion and implement accountability where it matters most — at the highest.

Rebuilding Trust Through Technology

Modern tax systems not depend on random audits. They use risk-based computer-assisted audit systems powered by AI, blockchain, and data analytics to discover red flags and detect undeclared wealth.

The BIR should integrate data from the Commission on Audit (CoA), the Anti-Money Laundering Council (AMLC), the Securities and Exchange Commission (SEC), the Bureau of Customs (BoC), and the Office of the Ombudsman. Linking tax filings with Statements of Assets, Liabilities, and Net Value (SALNs) can uncover unexplained wealth in real time — a task unattainable under manual systems.

Global experience shows that risk-based auditing can double audit efficiency and lift revenues by as much as 200%, with most gains coming from high-yield, high-risk taxpayers. For this to work, Congress must lift bank secrecy for public officials, allowing tax authorities to confirm if their declared income aligns with actual wealth. Transparency is the cornerstone of trust.

Relief with Responsibility

Tax reform should be fair in addition to firm. The Department of Finance’s (DoF) proposal to boost tax-free profit limits and ease the burden on Filipino staff is long overdue. Updating the income tax exemption threshold from P250,000 to P400,000 or P500,000 — as proposed in Senator Win Gatchalian’s Ginhawa Bill — would finally align tax policy with economic reality.

The brink has not modified since 2018, whilst prices surged and the associated fee of living climbed. Adjusting it would offer real relief for middle-income earners — the backbone of the economy — while boosting consumption and voluntary compliance. Any temporary revenue loss could be offset by reducing leakages, automating processes, and targeting true evaders.

Digital Transformation and VAT Reform

Beyond audits, transparency demands automation. The Electronic Invoicing System (EIS) should be fully implemented and prolonged to all professionals and repair providers. Real-time monitoring of sales and income will minimize underreporting and corruption at every level.

Likewise, the World Bank’s advice to broaden the VAT base — removing most exemptions except essentials like food, health, and education — offers a transparent path to scale back the speed from 12% to 10% without losing revenue. An easier, broader VAT will strengthen compliance, fairness, and competitiveness.

From Response to Reform

The President’s directive is a welcome start—but the true test is consistency. The BIR, DoF, and Congress must now institutionalize risk-based auditing, digital invoicing, inter-agency data sharing, and public accountability.

A government that enforces tax justice at the highest will earn the moral authority to gather taxes from the remaining. The Philippines doesn’t need higher taxes; it needs a wiser system that rewards honesty, punishes corruption, and restores public trust.

Only then can we transform our tax system from one built on fear to at least one built on fairness — where doing the correct thing is not any longer the toughest thing to do.

In regards to the Writer

Mon Abrea is a Global Tax Policy Expert and Chief Tax Advisor of the Asian Consulting Group (ACG). An alumnus of Harvard, Oxford, and Duke Universities, he works with governments and international institutions on tax reform, investment policy, and governance. Recognized among the many TOFA 100 Most Influential Filipinos within the World, he leads global initiatives through his Reimagining the World book series, Thought Leaders and Game Changers podcast, and International Tax & Investment Roadshow, promoting the Philippines as an ESG-aligned investment destination.

Highlight is BusinessWorld’s sponsored section that permits advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Website online. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.