By Katherine K. Chan, Reporter

THE PHILIPPINES’ balance of payments (BoP) deficit in 2025 settled below the central bank’s full-year forecast despite posting a wider deficit in December.

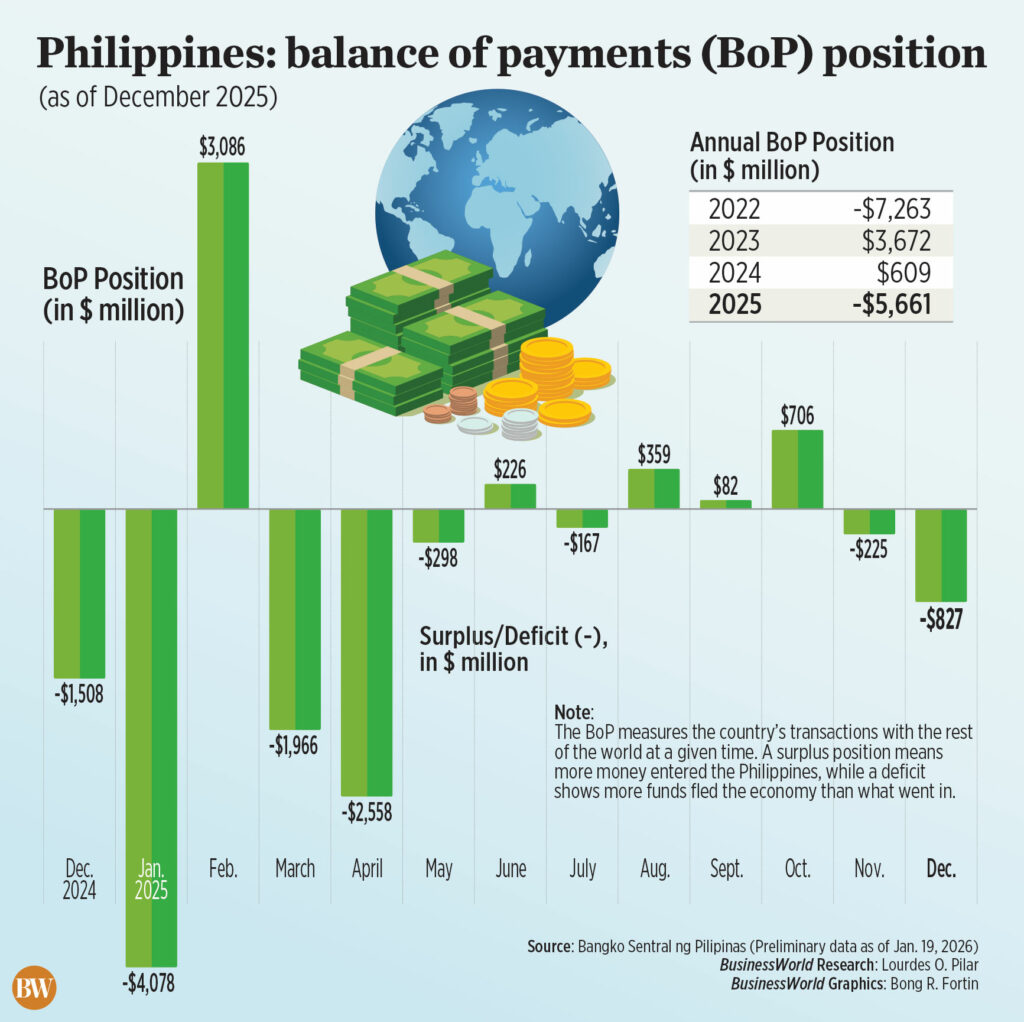

Data from the Bangko Sentral ng Pilipinas (BSP) showed that the country’s BoP position swung to a $5.661-billion deficit, a reversal from the $609-million surplus seen in 2024.

This was narrower than the central bank’s projection of a $6.2-billion gap or -1.3% of the country’s gross domestic product (GDP).

In December alone, the BoP deficit narrowed yr on yr to $827 million from a $1.508-billion gap.

Nonetheless, it widened from the $225-million shortfall recorded in November.

“The Philippines’ balance of payments registered an $827-million deficit in December 2025, bringing the total‑yr consequence to a $5.7-billion deficit,” the BSP said in an announcement late on Monday.

BoP refers back to the country’s economic transactions with other nations. A surplus indicates more funds entered the country, while a deficit shows that the country spent greater than it received.

Rizal Industrial Banking Corp. Chief Economist Michael L. Ricafort said the BoP deficit in December was partly resulting from the country’s continued trade deficit.

The Philippines’ trade-in-goods balance, or the difference between the values of exports and imports, narrowed to a $45.2-billion gap as of end-November from $50.18 billion in the identical period in 2024.

Meanwhile, John Paolo R. Rivera, a senior research fellow on the Philippine Institute for Development Studies, said subdued capital inflows and foreign direct investments, in addition to sustained net outflows from portfolio investments, can have also fueled the recent BoP deficit.

“It reflects a mixture of weaker capital inflows, softer FDI (foreign direct investment), and continued net outflows from portfolio investments, alongside a persistently wide trade deficit driven by imports,” he said in a Viber message.

“(The December) deficit likely reflects year-end debt servicing, profit repatriation, and portfolio rebalancing, that are typical toward the close of the yr.”

FDI net inflows have recorded double-digit annual declines every month since August 2025. In October, it slumped by 39.8% to $642 million from $1.067 billion a yr ago.

Mr. Ricafort said the country’s BoP position may improve within the near term if the administration’s governance reforms would materialize.

“For the approaching months, BoP data would improve further if anti-corruption measures and other reform measures, especially in further leveling up the country’s governance standards, are taken seriously, identical to 10-15 years ago, as these help further improve international investor confidence within the country,” he said in an e-mail.

RECORD DOLLAR RESERVES

Meanwhile, the central bank’s dollar reserves stood at $110.833 billion as of end-2025, 4.31% higher than the $106.257 billion logged within the prior yr.

This marked a brand new all-time high gross international reserves (GIR) level on an annual basis, breaking the previous record of $110.117 billion at end-2020.

The dollar reserves level in 2025 also exceeded the BSP’s estimate of $109 billion for the yr.

At end-December, the country’s GIR level translated to 7.4 months’ price of imports of products and payments of services and first income, well above the three-month standard.

“Specifically, the most recent GIR level ensures the supply of foreign exchange to satisfy balance of payments financing needs, reminiscent of for payment of imports and debt service, in extreme cases when there are not any export earnings or foreign loans,” the central bank said.

It’s also enough to cover about 3.9 times the country’s short-term external debt based on residual maturity.

GIR comprises foreign-denominated securities, foreign exchange, and other assets such as gold. It enables a rustic to finance imports and foreign debts, maintain the steadiness of its currency, and safeguard itself against global economic disruptions.

For Mr. Rivera, a rebound in FDIs, export performance, remittance inflows, the US Federal Reserve’s monetary policy actions, amongst other global financial conditions, will determine the country’s BoP position this yr.

“While near-term pressures from global uncertainty and PHP (Philippine peso) weakness may persist, a pickup in investments and exports could help narrow the deficit this yr, with GIR expected to stay broadly stable barring major external shocks,” he said.

For 2026, the BSP expects the general BoP position to finish at a $5.9-billion deficit or -1.2% of the Philippine GDP. Meanwhile, it sees the GIR level reaching $110 billion by yearend.