By Katherine K. Chan, Reporter

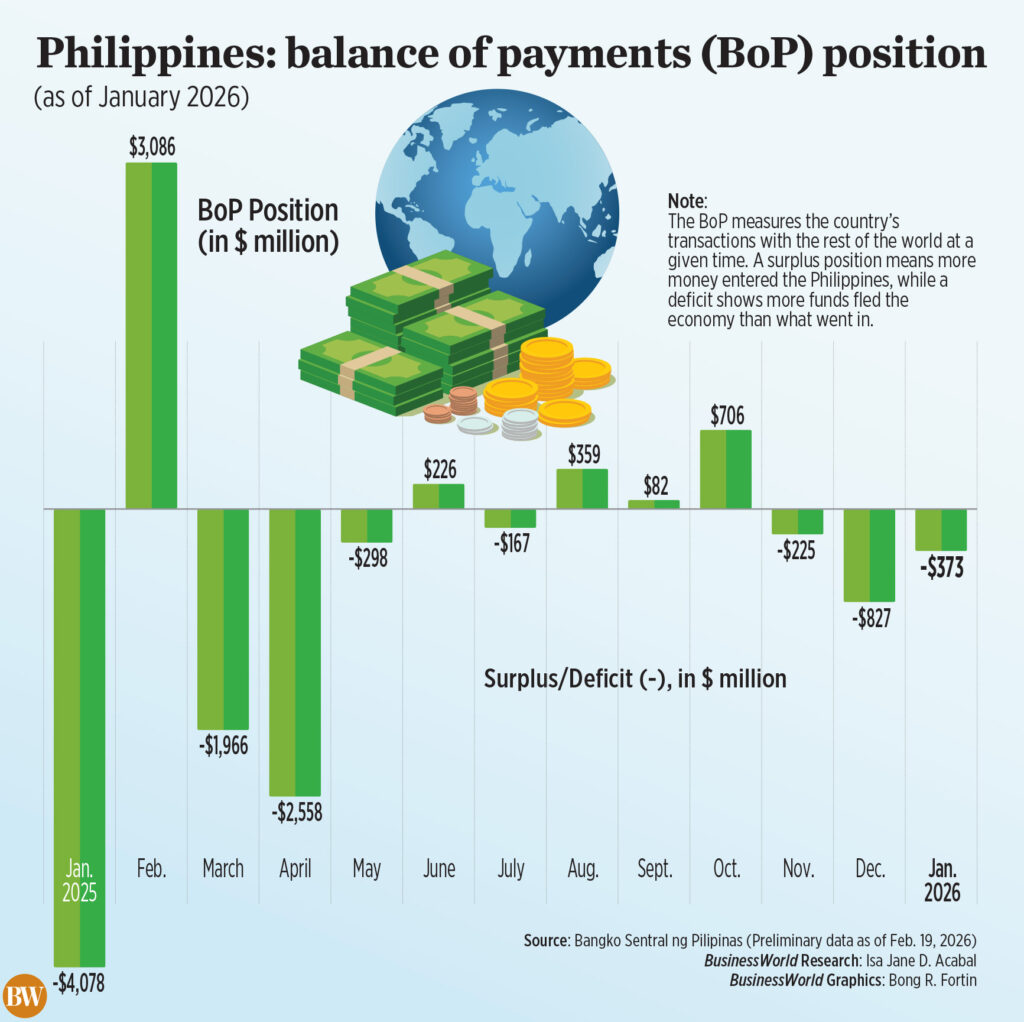

THE PHILIPPINES’ balance of payments (BoP) deficit sharply narrowed to $373 million in the primary month of 2026, the Bangko Sentral ng Pilipinas (BSP) reported.

Based on central bank data released on Thursday, the country’s BoP position stood at a $373-million shortfall in January, sharply narrowing from the $4.078-billion gap recorded in the identical month last 12 months.

It was likewise smaller than the $827-million deficit posted in December 2025.

January also marked the third straight month that the country’s BoP position stood at a deficit.

BoP refers back to the country’s economic transactions with other nations. A surplus indicates more funds entered into the country, while a deficit shows that the country spent greater than it received.

“[The] deficit largely reflects seasonally strong import payments and profit remittances at the beginning of the 12 months, alongside some portfolio repositioning amid global rate uncertainty,” SM Investments Corp. Group Economist Robert Dan J. Roces said in a Viber message.

Easing external pressures at the beginning of the 12 months in addition to regular inflows of remittances and services could have also driven the narrower deficit, he added.

Jonathan L. Ravelas, a senior adviser at Reyes Tacandong & Co., said the BoP deficit got here on the back of the country’s persistent trade deficit.

“The BoP remains to be in deficit mainly because imports are outpacing exports,” he said via Viber. “That reflects strong domestic demand and infrastructure spending, while global demand for our exports — and services like BPO (business process outsourcing) and tourism — has been softer.”

Latest data showed that the country’s trade-in-goods deficit ended 2025 at its narrowest level in 4 years at $49.17 billion, down by 9.5% from the $54.33-billion shortfall logged in 2024.

Nevertheless, Mr. Ravelas noted that the BoP deficit is “not a crisis signal,” noting that the Philippines’ external buffers are still solid.

“This isn’t a crisis signal; it’s a growth-related deficit, and our external buffers remain solid,” he said.

Within the near term, the Philippines’ BoP position could remain at a deficit but may stabilize on account of recovering exports, improving tourism and rising remittance inflows.

“In the approaching months, the BoP should stabilize as remittance inflows rise and tourism receipts improve, though much will rely upon oil prices, electronics exports, and the direction of US rates,” Mr. Roces said. “At this level, the deficit stays manageable and doesn’t point to external vulnerability.”

Investment reforms may provide some relief for the country’s BoP position, Mr. Ravelas added.

“The important thing now could be to spice up export competitiveness and attract more long-term investments, quite than overreacting to the headline number,” he said.

For this 12 months, the central bank expects the BoP position to finish at a deficit of $5.9 billion or -1.2% of the country’s gross domestic product.

16-MONTH HIGH RESERVES

Meanwhile, the Philippines’ foreign reserves rose to their highest level in over a 12 months at $112.6 billion at end-January.

This was the best in 16 months or when the gross international reserves (GIR) level stood at $112.707 billion at end-September 2024.

Month on month, it climbed by nearly 1.6% from $110.833 billion in December.

In the primary month of the 12 months, the country’s GIR level translated to 7.5 months’ price of imports of products and payments of services and first income, exceeding the three-month standard.

“Specifically, the most recent GIR level ensures the provision of foreign exchange to satisfy balance of payments financing needs, equivalent to for payment of imports and debt service, in extreme cases when there aren’t any export earnings or foreign loans,” the BSP said in a press release.

It is usually enough to cover about 4.1 times the country’s short-term external debt based on residual maturity.

GIR comprises foreign-denominated securities, foreign exchange, and other assets equivalent to gold. It enables a rustic to finance imports and foreign debts, maintain the soundness of its currency, and safeguard itself against global economic disruptions.

The BSP projects the Philippines’ dollar reserves to hit $110 billion by yearend.