That is an audio transcript of the FT News Briefing podcast episode: ‘Why Trump may desire a weaker dollar’

Sonja Hutson

The US dollar is down this 12 months by quite a bit, and it’s making some people think twice about its role because the world’s reserve currency. Now, that’s a reasonably radical proposition after many years of dollar dominance, and it could have consequences for the US. But recently, there have been signs that President Donald Trump could desire a weak dollar.

[MUSIC PLAYING]

That is Swamp Notes, the weekly podcast from the FT News Briefing, where we discuss the entire things happening in US politics. I’m Sonja Hutson. And this week we’re asking: could a plan to weaken the dollar make America great again? Here with me to debate is Gillian Tett, a longtime economics commentator for the FT, and the previous editor of Moral Money. Hi, Gillian.

Gillian Tett

Great to be on the show.

Sonja Hutson

Great to have you ever. We’ve also got Katie Martin, host of the Unhedged podcast, and writer of the FT’s weekly Long View column. Hi, Katie.

Katie Martin

Hi, hi. Thanks for having me.

Sonja Hutson

Thanks for being on the show. So Gillian, I’m gonna start with you, and I would like to ask you to only set the scene for us. Why are we talking about this this week?

Gillian Tett

We’re talking about it this week since the markets are in the midst of a really nasty wave of volatility and turmoil. And although most individuals expected the stock market to soar under Donald Trump, and it did initially soar, and in addition they expect the dollar to strengthen quite sharply. In point of fact, the stock market has been tumbling and officially got into correction territory. And the dollar has weakened and it’s spooking numerous people.

Sonja Hutson

So Katie, are you able to give us slightly bit more detail about what has been occurring with the dollar recently and what individuals are saying about it?

Katie Martin

Yeah. So, it has been a really interesting week that, as Gillian says, there was an enormous shake-out in US stock markets. And one among the things that’s interesting about that’s that different bits of it aren’t matching up in the way in which that they typically do. So typically, if investors are feeling nervous about stuff, then they buy the dollar, they usually buy US government bonds. And one thing that’s really protruding to me in the intervening time is that that’s not likely happening. Yes, individuals are selling US stocks. European markets are hanging on significantly better, but you’re not seeing an explosive jump within the dollar or in US government bonds, and there needs to be a reason for that.

And there’s a few interpretations. One is that investors are taking a view that every one of this backwards and forwards from the Trump administration on tariffs on, tariffs off, it makes it a really difficult environment for businesses to succeed. And it points towards a slowdown within the US economy. That helps to drag down the dollar. But we even have this kind of point where because bonds aren’t jumping in the way in which that they normally do, that tells me the investors think not that that is necessarily just an economic slowdown. This isn’t something that the Federal Reserve can cut rates into to kind of solve the issue. It suggests there’s slightly little bit of nervousness around US government bonds and the dollar in and of themselves as investment destinations, and that’s an enormous break with the past, potentially.

Sonja Hutson

OK. So that is something beyond what we might normally expect of the markets. Gillian, where do you think that President Trump’s head is in all of this?

Gillian Tett

So Donald Trump’s vague goal, insofar as he has a goal, is so-called to make America great again. He’s not an amazing economic thinker. I feel he’s driven more by emotion and instinct, so he vaguely desires to try to make America great again. That’s the overarching goal. The strategy that’s emerging around a few of his advisers is to try to reset the worldwide financial and trade system. And I should say the military system as well, because they see them as entwined in really quite a radical way. And the tactics they’re using are principally classic bully boy tactics of aggression and threats and each military and financial and business. All of the tariffs which can be on again, off again, and the air of unexpected capriciousness and uncertainty that’s leaving everyone else on the defensive and on their toes.

Sonja Hutson

Right. In order you wrote recently, the chaos around tariffs and other things that the Trump administration have been doing is a feature, not a bug. The uncertainty helps the Trump administration create this environment during which countries will want to sign deals which can be bad for them simply to stop feeling endlessly threatened by the US. Katie, what’s the argument for why a powerful dollar has actually disadvantaged the US?

Katie Martin

The pondering from people near Trump is that the role of the dollar as such a large a part of the worldwide economic system is a blessing and a curse. So people sometimes check with it as a little bit of a burden, and that’s because investors of all different stripes all around the globe scoop up US dollar assets, that pushes the dollar higher. And the upper the dollar is, the costlier US exports to the remaining of the world change into. So the argument is that that is one a part of the rationale why US manufacturing has been hollowed out, so other countries can weaken their currencies, and that makes their exports more attractive. And it’s rather more difficult for the US to try this because there’s such an enormous bedrock of demand for US dollar assets. You recognize, that features stocks, but additionally US government bonds.

But whenever you actually get all the way down to the nuts and bolts of how you may give you the option to square this circle and give you a way during which the world’s, you recognize, goods and commodities are still priced in dollars, and the world’s economic system sort of reverts back to dollars and is predicated in dollars, but you don’t have a powerful dollar, it’s quite difficult to assume how those two things match up. And in addition, it sort of overlooks the concept because you’ve gotten a powerful dollar, that implies that the US has been in a improbable position over the past few many years to purchase goods and services from overseas really cheaply, but the main target for the US administration is on manufacturing. You recognize, a few of the advisers near Trump draw a reasonably straight line between the opioid crisis within the US and the position of the dollar. So that they see this as strategically very essential to the administration. However it’s an awfully difficult thing to repair.

Sonja Hutson

So let’s talk slightly bit about those nuts and bolts of how this might actually occur. There’s this recently resurfaced essay by Stephen Miran, who’s now chair of Trump’s economic advisers. Scott Bessent, the Treasury secretary, has also weighed in on a few of these theories. What’s their idea of the best way to actually make this occur and devalue the dollar?

Gillian Tett

Well, I feel that he’s, initially, laying out a set of ideas which is able to horrify many individuals, and which some people would dismiss as mere lunacy, and, you recognize, contradictory. But these ideas do have a really strong internal logic, even if you happen to don’t prefer it. And so they are actually affecting the way in which that the administration looks at what it’s doing in the intervening time. And Miran himself admits that the trail to really implementing this big reset of the worldwide financial and trading system is, quote, very narrow. So what they wish to do is, one solution to explain it, is thru Scott Bessent’s Three Arrows framework, which is borrowed from the Japanese, and that involves aiming for a 3 per cent deficit, a 3 per cent growth rate and a $3mn barrel increase in oil production. And so they consider that, essentially, they’ll use the dramatic increase in oil and gas production to lower energy costs, which, coupled with deregulation, will mean there’s less inflation within the economy and offset the possibly inflationary impacts of tariffs. That’s the speculation.

They think that deregulation and tax cuts will drive fast growth and essentially enable the US to grow its way out of the deficit and debt. They think that cutting the federal government, as Elon Musk is doing through such a dramatic set of, you recognize, so-called Doge programs, would essentially enable the private sector to flourish dramatically and offset any drag down from reducing government activities. And in addition they think that they’ll use tariffs to threaten other countries into essentially opening up quite a bit more of their markets at a lower cost to American products and or putting quite a bit more investment into America to assist the American economy. And that insofar because it threatens to strengthen the dollar, they’ll give you the option to get other countries together, and they’ll collectively conform to weaken the dollar through a treaty and a deal. And along with that, they’re taking a look at other mechanisms to try to change capital flows. One idea is to restructure parts of the US debt with forcing Treasury holders to swap it for long run, but potential instruments. One other idea is to try to put taxes or some sort of break on the capital inflows so as to, again, rebalance the present account and the trade as well. These are all highly controversial ideas. They could never see the sunshine of day, but those are a few of the ideas floating around as people attempt to formulate a plan for the second Trump term.

Katie Martin

I mean, one among the interesting things there’s that, you recognize. . . Gillian is kind of right to emphasize that none of this will see the sunshine of day. But in a way, that will not matter, because already what is occurring amongst investors that I speak to and analysts at investment banks that I speak to is that just the presence of this uncertainty and the presence of this concept swirling across the corridors of power is sufficient to make some investors query whether or not they wish to be as heavily exposed to US assets as they’ve been previously. So the administration is, perhaps unwittingly, already sowing some uncertainty into stuff that’s purported to be the risk-free part of worldwide markets. And so it might be, as Gillian says, that in policy circles, people aren’t talking in regards to the end of the dollar as a reserve currency. But in markets, I can assure you that folks are talking about that at the same time as a fringe possibility. And also you only need to undermine that kind of credibility and reliability slightly bit. Threats have potentially quite a big impact.

Sonja Hutson

So Gillian, I read your piece about this as sort of a warning to not underestimate the intentionality of the Trump administration, but how likely do you think that it’s that Trump actually attempts to do all of this?

Gillian Tett

Well, I feel attempting to predict what Trump’s gonna do is an absolute mug’s game. (Laughs) And, you recognize, if I knew what was in his mind, you recognize, I could be probably trading the markets. The, you recognize . . . So there are a variety of aspects we just don’t learn about. One is how these factions around him proceed to compete and who comes out on top. Secondly, we don’t understand how he’s gonna respond if the stock markets collapse, and if there’s some sort of populist revolt. Already, we’re getting signs that parts of the Maga base are pretty unhappy, and that might swell, and that might force a substantial U-turn. And we all know that Trump has no scruples about firing people when he’s under pressure in charge them. And the opposite thing we don’t learn about is how the remaining of the world responds. I mean, there’s that wonderful issue of events, the primary events, and we might even see some dramas on the world stage, which again force a switch in policy.

Sonja Hutson

What about you, Katie? What are you desirous about as we wrap up this conversation?

Katie Martin

I feel the thing underpinning this whole conversation that’s really essential to keep in mind is that cash is power and the dollar is power. So, for instance, when Russia launched its full-scale invasion of Ukraine three years ago, one really essential thing that the US did in response to that was shut Russia out of the dollar economic system and freeze its dollar reserves. This was a very essential way of attempting to bring Russia to heel. And that’s only possible since the US is home to the world’s dominant reserve currency. If it surrenders that role to either one among the country or economic zone, or a series of other countries or economic zones, then it loses that power on the geopolitical stage. Now, we’re a good distance from that occuring without delay. However the undeniable fact that it is a conversation that serious individuals are taking seriously, I might argue it makes this an important moment.

Gillian Tett

The people who find themselves gonna find yourself as winners of this are principally lawyers who’re busy advising corporations on how on earth to address these tariffs. Some bond traders and other very quick-footed hedge fund traders, probably a few of the people around Trump who might be dabbling within the markets concurrently they’re engaged in other points of (inaudible) advice and, dare I say it, journalists, because there’s gonna be numerous need for people to try to explain what on earth is occurring.

Sonja Hutson

All right. We’re gonna take a fast break, and once we come back, some serious individuals are gonna do a brand new segment called Out of the Swamp.

[MUSIC PLAYING]

And we’re back with Out of the Swamp, where we ask our guests to recommend stories they’re watching outside of Washington. Katie, why don’t you go first? What’s occurring outside DC for you?

Katie Martin

I’m going to cheat slightly bit. One story that’s sort of not directly linked to what’s occurring in Washington is there’s a very fun story from our colleague Leslie Hook within the FT. There’s a facility in Switzerland that melts down gold bars from the usual London size, which is in regards to the size of a brick, and reformats them in standard Recent York size, which is in regards to the size of a smartphone, in order that it may well be sent across the Atlantic to satisfy massive amounts of gold demand, particularly within the states, particularly not directly linked to Trump. And it’s just a very fascinating story about what actually happens in the heart of monetary markets. So a small cheat on my part, but I feel you’re going to let me off.

Sonja Hutson

I will certainly allow you to off, especially because that is an excellent, fun fact to bring up at dinner parties. I didn’t know that there have been different standard sizes of gold bars.

Katie Martin

Yeah, who knew?

Sonja Hutson

Alright, cool. Gillian, what about you? What are you taking a look at?

Gillian Tett

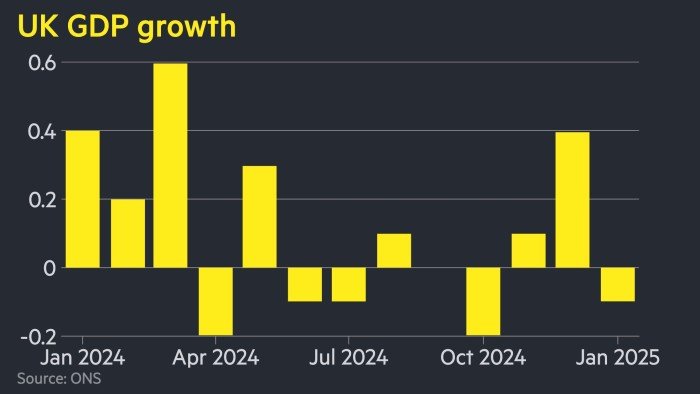

I might argue it’s less fun, nevertheless it’s very essential, is the pressure’s constructing within the UK, as you see, very weak economic growth. We just have data suggesting the economy contracted barely previously three months. And that actually puts pressure on the British government to work out how on earth they’ll devise policies to get themselves out of this potentially quite stagflationary mess, on condition that they’re caught in a really difficult position between America and Europe without delay.

Sonja Hutson

All right. Well, it’s actually not only the US that’s coping with a posh set of economic circumstances. I wanna thank our guests, Katie Martin, host of the Unhedged podcast and writer of the FT’s Long View column. Thanks, Katie.

Katie Martin

Pleasure.

Sonja Hutson

And Gillian Tett, longtime FT editor and contributor, and formerly the editor of Moral Money. Thanks, Gillian.

Gillian Tett

Thanks.

[MUSIC PLAYING]

Sonja Hutson

This was Swamp Notes, the US politics show from the FT News Briefing. For those who wanna enroll for the Swamp Notes newsletter, we’ve got a link to that within the show notes. Our show is mixed by Sam Giovinco and produced by Katya Kumkova. Special because of Pierre Nicholson. I’m your host, Sonja Hutson. Our executive producer is Topher Forhecz, and Cheryl Brumley is the FT’s global head of audio. Original music by Hannis Brown. Check back next week for more US political evaluation from the Financial Times.